Every person I have ever met who has built real, long term generational wealth has done so slowly. Over the course of decades. Every person I have ever met who is constantly chasing the next way to get rich quick is broke. I don’t think my experience on this is unique. Get rich quick = stay broke forever.

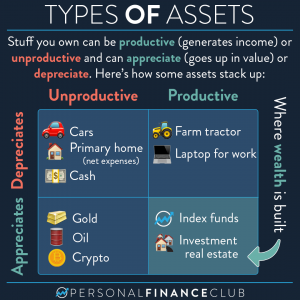

Here are some bad ways to build wealth: day trading, MLM schemes, forex trading, bitcoin, stock tip newsletters, investing in a friend’s businesses, the lottery, and pretty much anything else that makes you pause and think, “Is this too good to be true?”. It is.

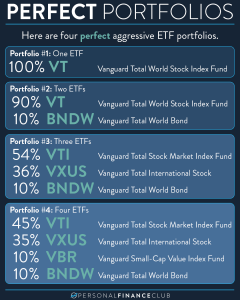

Here are some good ways to build wealth: Spend less money than you make. Invest the difference. Buy and hold index funds. Buy and hold investment real estate. Grow a business over decades. Slowly put away money into your investments month after month, year after year.

And I get it. When you’re broke or young and hungry to build wealth the idea of a 10% return isn’t exciting. Put away a full $1,000 and wait a YEAR and you have $1,100? What’s the point? YOLO. But if you put away $500/month and wait 30 years, that’s a MILLION DOLLARS.

This is true no matter what age you are. I often get questions like “Hey, I’m 50 and have zero, what’s the secret you’re not telling everyone else so I can get rich much faster?” The secret is there is no secret. I’ve been posting it here every day for the last year and a half. Follow the two rules. If you want to get rich faster, follow the two rules harder.

And if you’re 50, you still likely have 30+ years of life to look forward to! That’s a long time frame to invest! Don’t try to get there next year. Start building real, long term, generational wealth. You’ll be glad you did when you’re 60 and still feel like you’re 30.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy

via Instagram https://instagr.am/p/CBqBLLoHDA4/