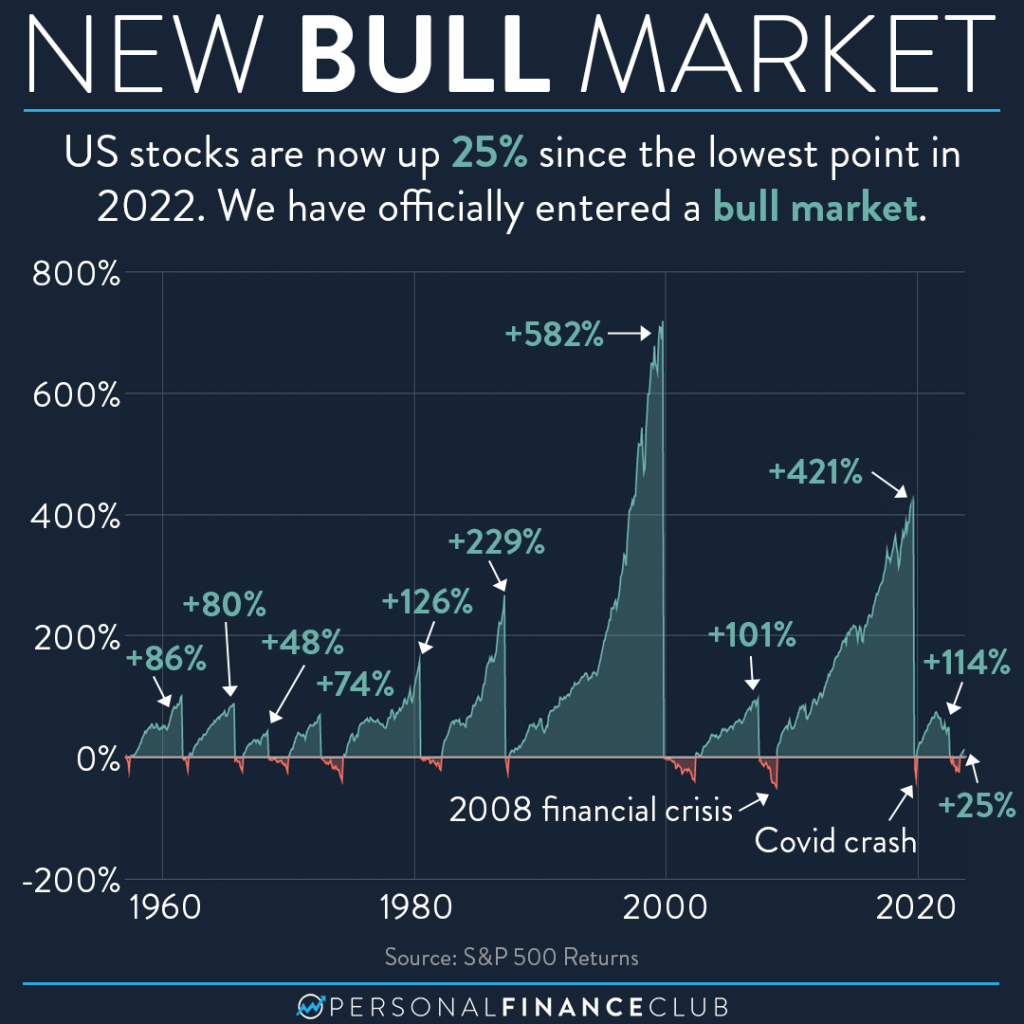

US stocks spent most of last year in a bear market but they are officially back in a bull market as of last week. What is a bull market? It’s a term Wall Street uses when the stock market has gone up by 20% or more. A bear market, on the other hand, is when it has gone down by 20% or more. As you can tell from the graph, if you invest over a long period of time, you will experience many bull and bear markets.

The average bull market lasts about five years and the market goes up 176%. The average bear market only lasts for 13 months and the market falls by an average of 34%. Bear markets can feel terrible when you live through them, but they are a small price to pay to get to enjoy the massive gains that a bull market can give you.

So why not try and invest during bull markets and stop investing during bear markets? Because it’s impossible unless you have a crystal ball. Trying to make tricky moves to speculate on the macroeconomic landscape is much more likely to hurt you than help you. To build wealth, simply stay the course. Keep investing a portion of every paycheck no matter what is happening in the markets. That way you can know that you will fully experience every bull market.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane

#bearmarket #marketcrash #stockmarket #bullmarket #dowjones #markethistory #data #economics #learntoinvest #staythecourse #beautifuldata #stocks #marketcrash