I was inspired to make this post when I was thinking about those little “investment amount” sliders that you often see as part of the 401(k) enrollment process for new hires. You can just slide them back and forth to decide what percent of your income you want to put into your 401(k).

I can picture the tens of thousands of young workers who are confronted with this slider daily. I imagine they look at it kind of confused, wondering what this 401k deal is and why they have to make this choice and also what’s for lunch.

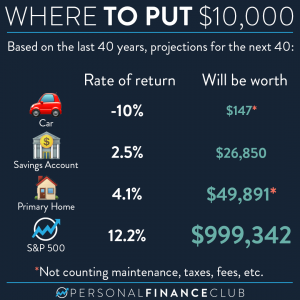

But what they don’t realize is that sliding that little dial over to the right will buy them YEARS of their freedom in the future. In that moment they’re making the decision between a little extra spending now or potentially decades of their life back in the future.

You have this choice too! Every day, week, and month when you’re spending today, you’re missing out on the opportunity to invest that money and let it GROW into even more in the future. That additional money can buy you years of freedom of choice about what you with your time!

Slide that dial over to the right, then meet me on your yacht in a few more years!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram