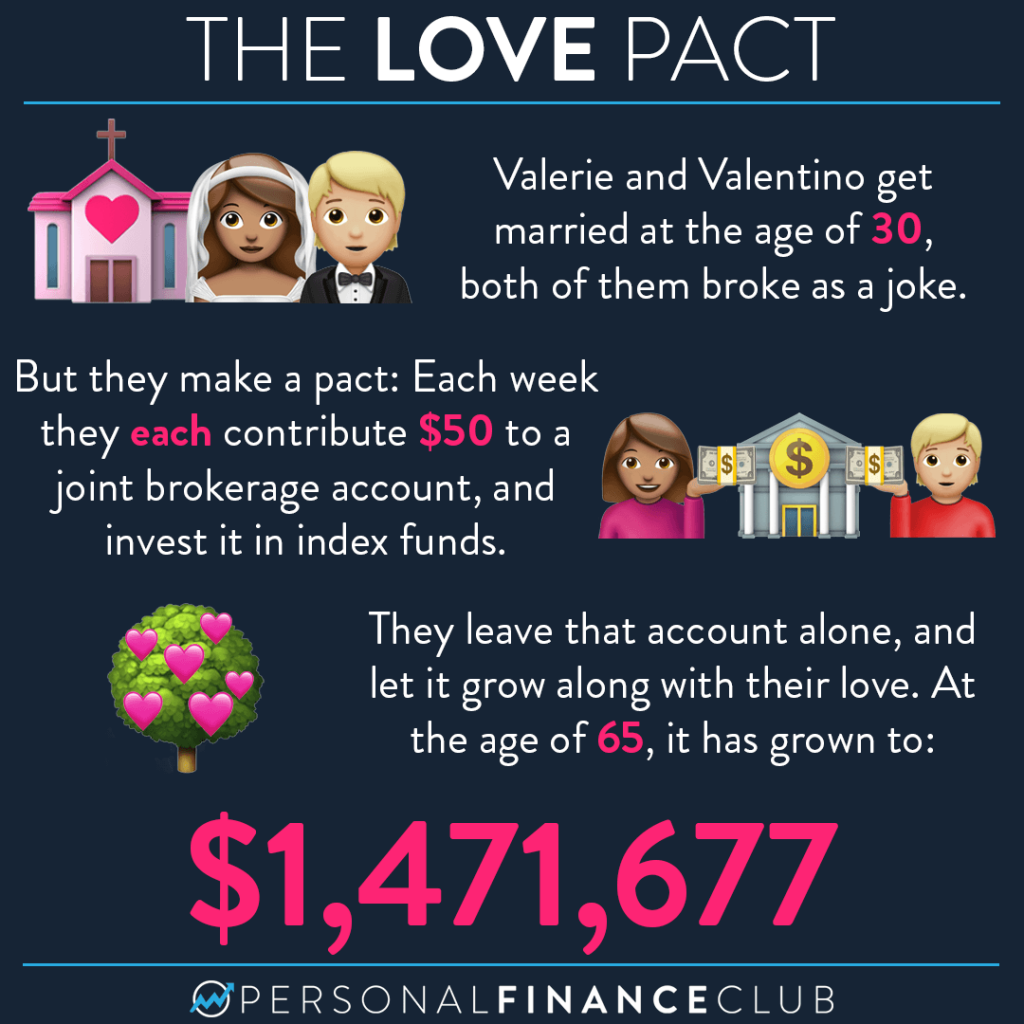

I wouldn’t call this an “optimal” investing plan. Notably, Valerie and Valentino decided to invest in a joint brokerage account, not individual Roth IRAs. Maybe it was the hopeless romantics in them, wanting their money to commingle. They knew that Roth IRAs, by law, are individual accounts. If they had chosen to invest in Roth IRAs, that $1.4M would actually be split about $735K each between their two IRAs (for the same total amount) but it would be 100% tax free!

In their joint account, the $1.4M is all together, but they’ll owe taxes on the gains. About $1.2M of that $1.4M is growth, so broad strokes, they might owe capital gains tax on $1.2M. If that’s 20%, leaving them with about $1.2M instead of $1.4M. Still, not all that bad, but a $200,000 missed tax savings!

ANYWAY, Happy Valentine’s Day! Talk to your loved ones about money! It’s a much sweeter present than any candy. Except cadbury eggs. Those are pretty darn good. But talking about money is good too, I guess. Just not quite AS good. But you can do it while you eat some delicious cadbury eggs, kinda killing two birds with one stone. And why is “killing birds” the metric we use for productivity? Seems like there could be a less violent way to express that.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram