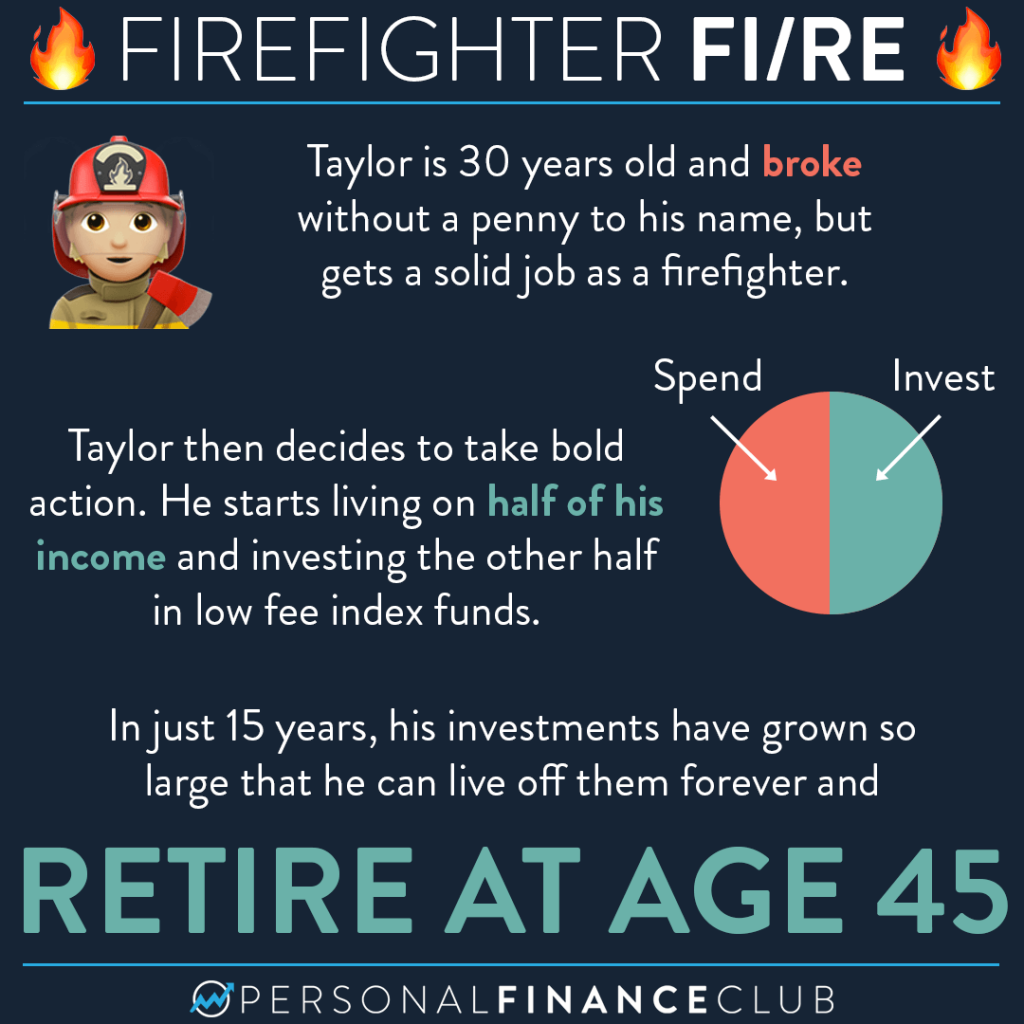

The cool thing about measuring your time until financial independence based on your savings rate is that it works no matter your income level. Spend half of what you make, and in 15 years your investments will grow large enough to provide for that level of spending forever! Spend all of what you make… well, you’re never gonna be able to retire at that pace!

Let’s say you make $60K/year. Think living on half of that is hard? Ask someone who makes $30K/year! It’s all relative. And if you make $30K/year… well, you’re probably not gonna realistically be able to live on half of that. It’s time to focus on growing that income while keeping your spending low!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram