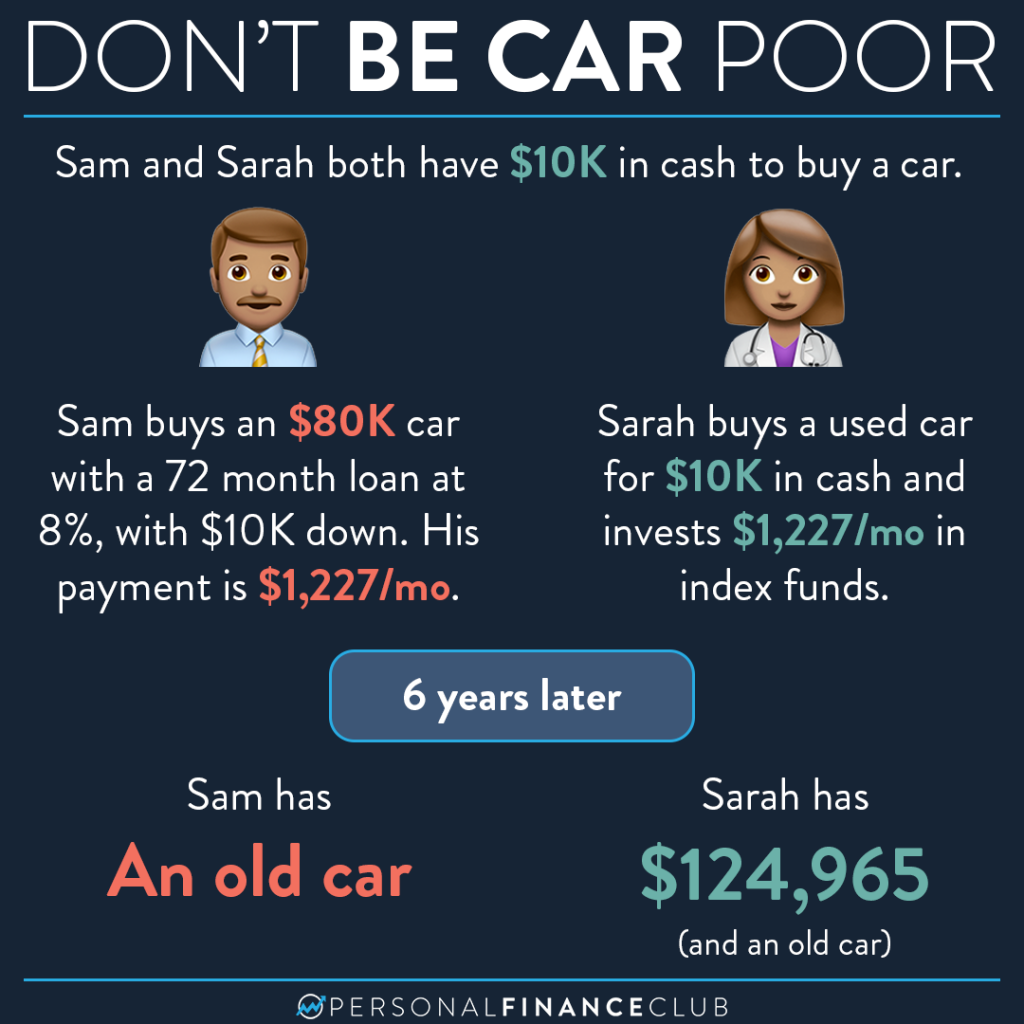

Getting a Starbucks latte or avocado toast probably is not going to be the thing that keeps you from getting rich. But buying an expensive car that you can’t justify is one of the best ways to ensure you don’t reach your financial potential. The large monthly payment can prevent you from investing and may even keep you saddled down to that job you don’t like since you can’t afford to take a risk.

You might think $1,227 per month is absurdly high for a car payment. But we hear stories all the time of people who have car payments well into the four digits. Which is not surprising considering the average car payment is $736 per month.

Yes, Sarah might have to pay more in maintenance for her older truck. But Sam will likely be paying more in sales tax, insurance, annual registration fees, extended warranty, maintenance for when the car is out of warranty, and so on.

Don’t buy more car than you can afford. It may be tempting when you see your friends driving the latest sports car or that really cool truck, but know that spending money today that you can’t afford just delays your potential to reach financial independence.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane