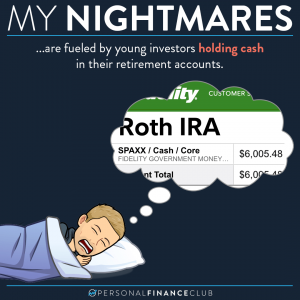

Over the last 10 years, their $150 per quarter added up to a total amount spent of $6,000 each. Victor spent his $6,000 on shoes causing the value to plummet. Old shoes generally have little to no resale value (yeah, I know there are some collectable Nikes, but you’re not getting them for $150). So 10 years later Victor is left with a closet full of shoes he has to figure out what to do with. They’re probably going to Goodwill when his partner decides they’ve had enough!

Vanessa, on the other hand, put her $6,000 to WORK over that 10 years. And that $6,000 found 16,350 little buddies for a total of $22,350. PLUS for being an owner, Vanessa is due quarterly dividends. At the moment Nike is paying out $0.275 per share, per quarter. Vanessa has accumulated 158 shares over the past 10 years, so she’s due about $170 per year! She could spend that and get a free pair of Nikes every year for life, or reinvest it, buying more shares for an even bigger payday later.

The point of this example isn’t to suggest you should never spend a penny on things that you like, but rather point out the power of the decisions you make with your spending. Spend a little less and invest it and a big payday awaits you down the road!

And if you’re wondering what Vanessa wore on her feet if she wasn’t buying shoes every three months, well, she lives in San Diego and just wears flip flops like me. It’s frowned upon at her job since she works as a welder, but it’s San Diego so everyone is pretty chill. No shirt, no shoes, no problem.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram