I’ve spent 43 years on this earth and had some success along the way. Here are some of lessons I’ve learned.

A lot of these fall under “simple but not easy”. Kinda like “diet and exercise”. I think we all know the basics of how to live a healthier lifestyle, but that doesn’t mean it’s EASY. But I still think this list was helpful to write down as a reminder of some of the big and small things we should be striving for.

To address some of the finance things:

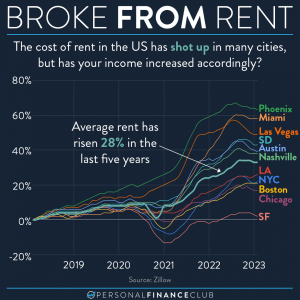

• Save cash for an emergency. Usually 3-6 months of your spending. Don’t be cash poor. Don’t be house poor.

• Don’t join an MLM. These tend to have worse returns than actual pyramid schemes.

• Don’t buy permanent life insurance. But DO buy term life insurance if you have dependents who depend on your work (in or out of the home)

• Don’t buy a timeshare. They’ll woo you with the sales pitch and say it’s an investment, but these generally have NEGATIVE resale value. You have to pay to get rid of them, and even many of the “timeshare exit” companies are additional scams. Steer clear.

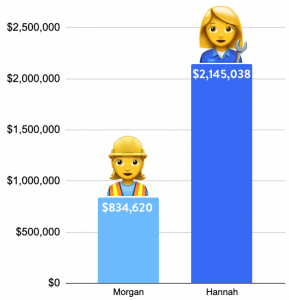

• Buy your cars in cash. Don’t borrow money for something that plummets in value. This choice alone can be the difference between millionaire and broke.

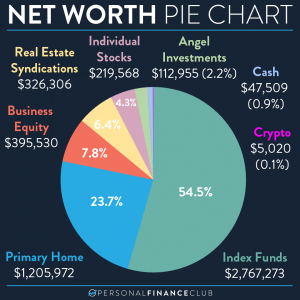

• Spend less than you make and invest! This is the “diet and exercise of personal finance”. Simple but not easy. Still worth striving for because it’s how rich people get rich.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy