This is me in January 2016 buying my first new car ever. In fact, it was the first car I ever owned that was built after the year 1999. My net worth at the time was about $2.7 million. The (very nice) Mazda CX-5 cost about $32,000. I wrote a check for it and drove it off the lot. Over five years later I still drive this Mazda and it still feels like my new car!

I actually became a millionaire about a year before this in 2015 when I sold the internet company I started in college. While I ran that company I never paid myself more than $36,000 per year (lowest paid employee at my company). I drove a 1999 Ford Explorer Sport for the previous six years that I bought for $3,000 cash.

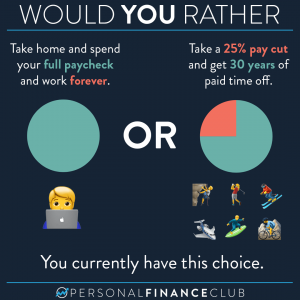

I wanted to share to give a view into how at least one millionaire behaves with cars. I recognize cars are a gigantic expense that plummet in value. I think they’re absurd as a “status symbol” (notice my broke chic look in this photo!) I think a lot of people buy fancy cars for a host of reasons. Like they’ve “earned it” (even though they can’t afford it). Or it’s a status symbol (of what? living beyond your means and being broke?). Or they need to portray success (I rolled up to ink my $5 million dollar deal in my ’99 Ford. Shockingly, there was no “you must drive a nice car” in the contract. They didn’t even ask what I drove!) Or you need safety features for your kids (…what car did YOU get driven around in as a kid?!) Or they don’t want to deal with maintenance (Do you want that more than you want to be a millionaire? Toughen up.)

I know all the new car ads can be tempting. But remember, you’re not defined by your car. In fact, I tend to find people who drive old beaters are cooler more interesting people in my experience. (That’s the exact cool factor I lost the moment this picture was snapped.) So drive your car for a few more years. Buy a used car in cash. Invest the difference.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram