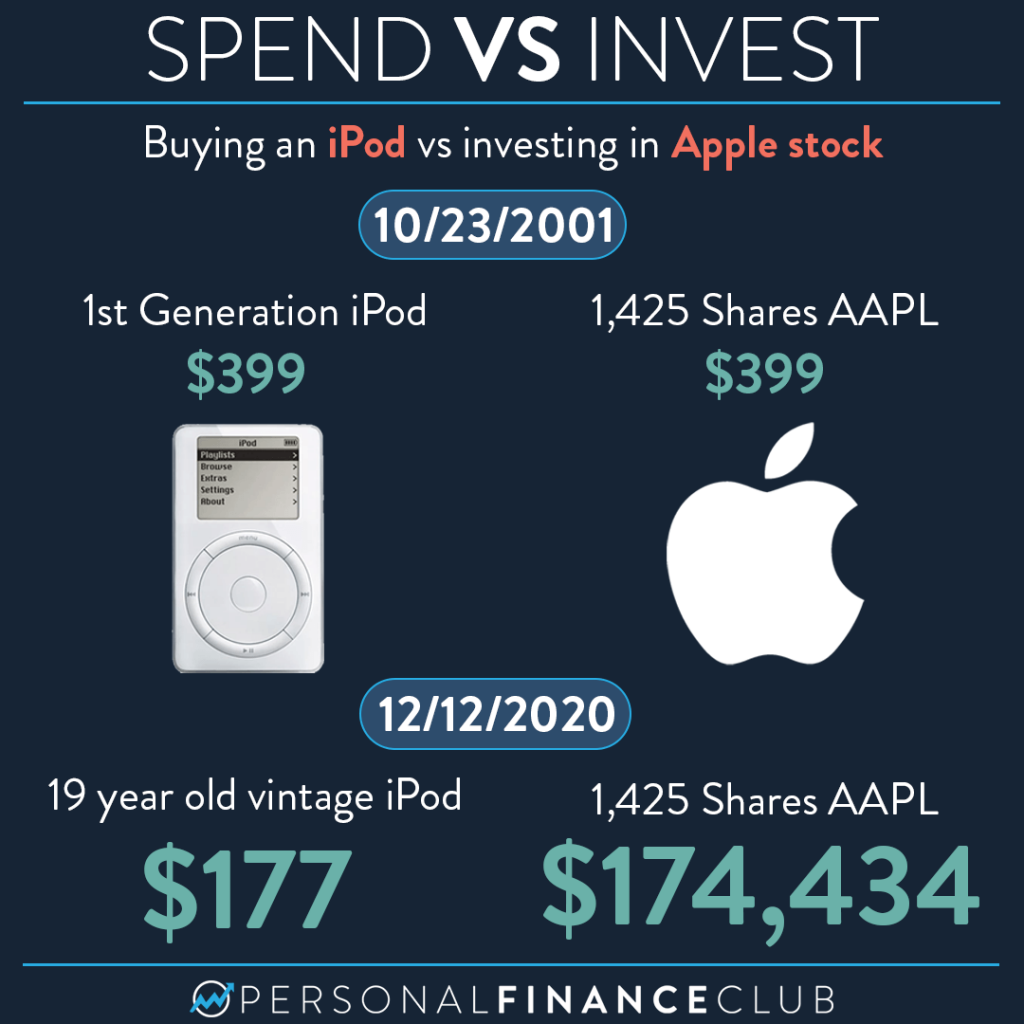

A habit I see among people constantly struggling with money is looking at money as something to spend. We’ve all seen it. Someone gets a bonus or has a windfall and mentally divides up how they’re gonna spend every dollar. New phone, new truck, fancy trip, etc. until the money’s gone. But a habit I always see among wealthy people is looking at money as something to grow. Spending the money makes it disappear. Investing it makes it grow exponentially.

This is one look at the dramatic difference someone would have seen if instead of buying a first generation iPod back when it was released they put that money into Apple stock and held it to today. Vintage iPods actually still go for a pretty decent price on eBay (I found a few in decent shape recently sold for $177). But those shares of Apple today, with dividends reinvested, would be worth $174,000.

Now this is obviously an extreme example that I put together for clickbait on Instagram. I chose one of the greatest stocks on the planet, something I could have only known with the benefit of hindsight. (In 2001 Apple was pretty much a joke). But looking forward, we can’t know which companies are going to outperform the market relative to their current share price. So instead of dumping all of your money into a single stock, the smart way to build wealth is to buy and hold index funds. That guarantees you the profits and growth from all the companies in the economy.

So next time you have some money, think about how you can cut down spending a bit and invest it for future growth!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram