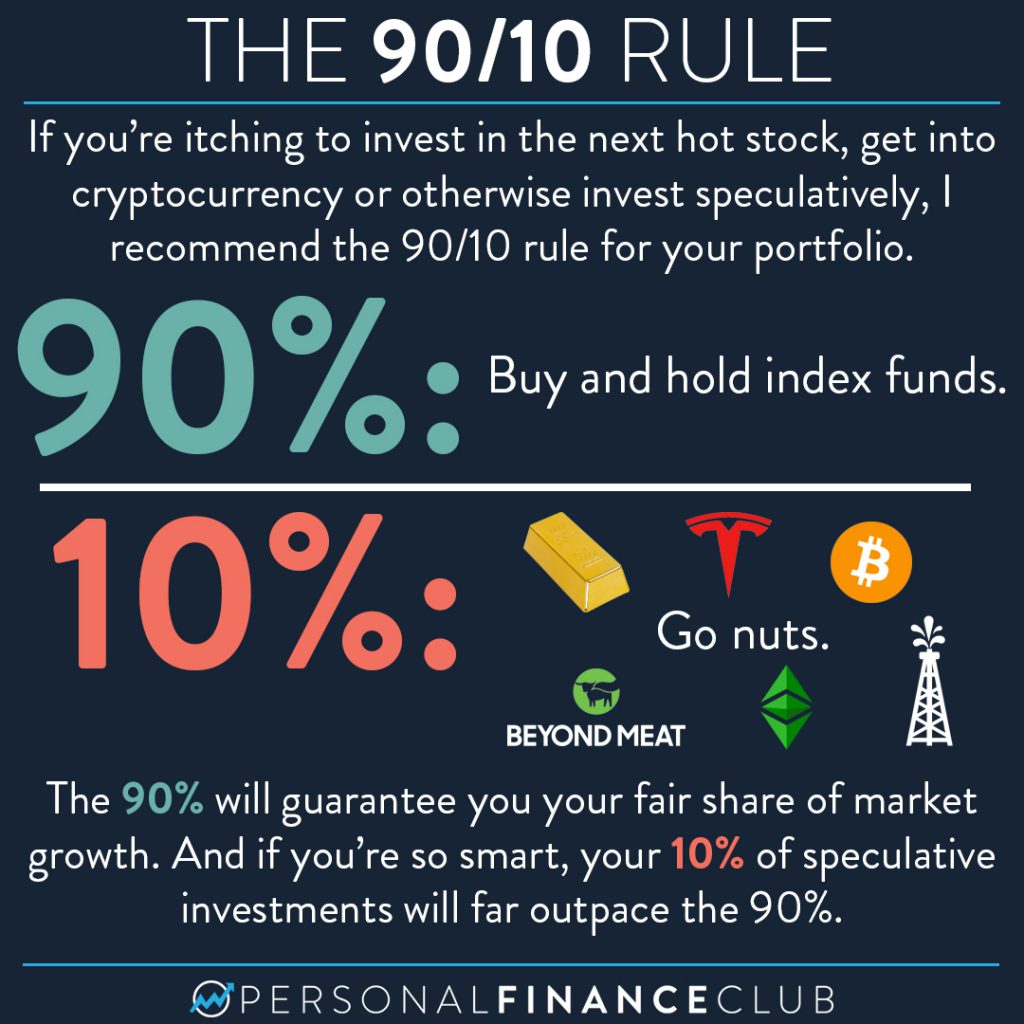

I believe the best way to maximize your future wealth is to buy and hold index funds.

But I get it. I know it’s tempting to stray from that simple course when you hear about the hottest new tech stock or have FOMO over bitcoin. So I suggest the 90/10 rule. With 90% of the contributions to your investment accounts, do the thing that has been proven over and over to beat the vast majority of investors and guarantees you your fair share of all market growth: Buy and hold index funds.

And with the other 10%? Go nuts. Buy bitcoin. Get in on the Lyft/Uber IPOs. Buy oil futures. Buy gold. Buy Tesla now that it’s way up and everyone suddenly realizes it’s a good company.

But if you do, be honest about how your two sections are doing against each other. It’s extremely likely that your index funds will grow faster than your speculation. The longer you do it, the more true that will be.

One way to implement this is to have two trading accounts. Every time you contribute money toward investing, put 10% in your speculation account. Keep a Google spreadsheet to track how they’re doing compared to each other. And be honest. It’s easy to focus on your winners and forget about your losers. The total account growth is what matters. And if it’s a taxable account, all that trading is going to be taxed more heavily than buying and holding too.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy

via Instagram