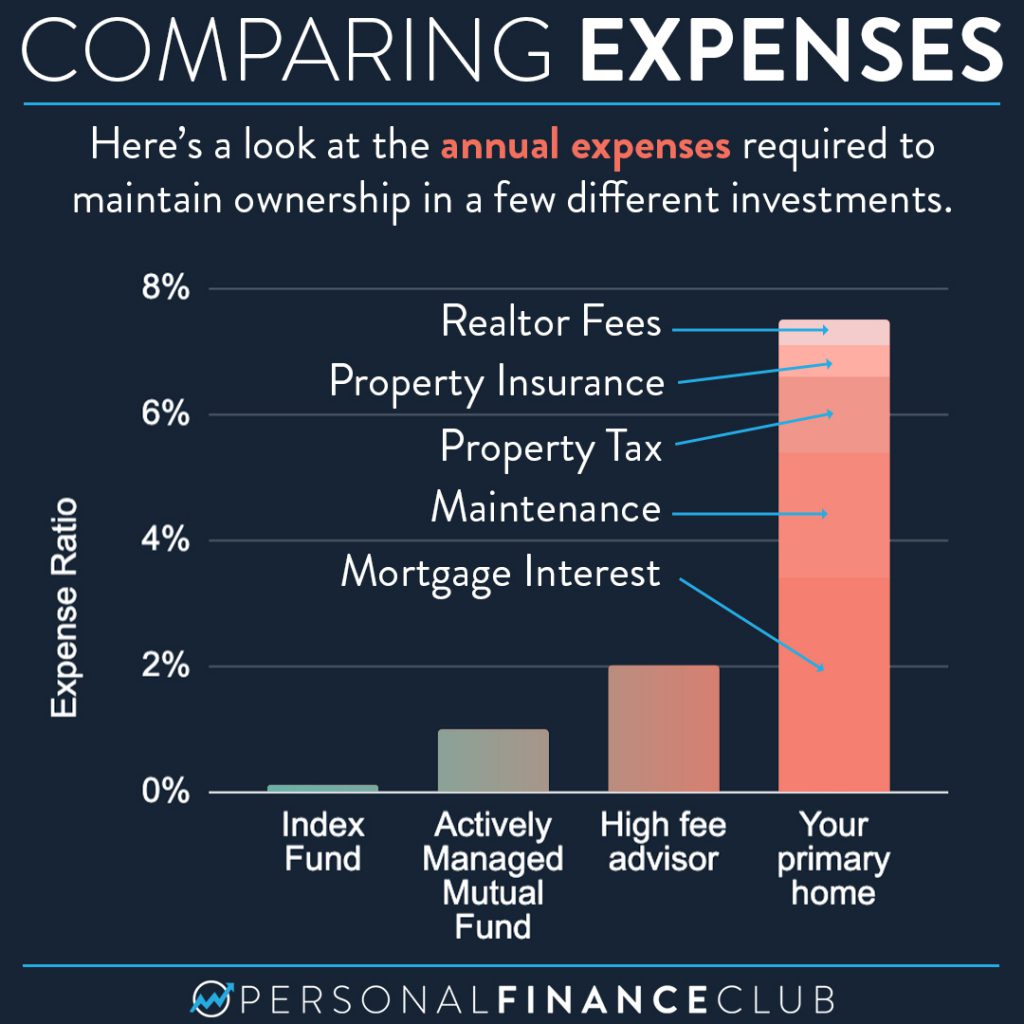

Recently there has been a price war between US brokerages over lowering fees on mutual funds. Decades ago a 1% annual expense ratio on a mutual fund would be considered pretty good. Then Vanguard shook up the industry, introducing the first index fund (VFINX) with a 0.14% expense ratio. Since then the prices have been getting driven down even further. Vanguard’s total stock market index fund (VTSAX) has a 0.04% expense ratio. Schwab’s (SWTSX) is 0.03%. Fidelity’s most popular total stock market index fund (FSKAX) is half that at 0.015%. Plus Fidelity finally went all the way and recently released FZROX with a 0% expense ratio.

Fans of index fund investing have loved this price war and the lowering of fees and will sometimes even switch brokerages to take advantage of a tiny reduction in expenses.

I think looking at the costs associated with housing as an expense ratio is a valuable way to realize the full extent of costs required to maintain that investment. A homeowner in the US spends on average 7.5% of the home value EVERY YEAR on sunk cost expenses. Let’s break them down:

- 3.4%: Mortgage interest (Assuming a 30 year fixed at 4% and owning for 13.3 years, the national average)

- 1.2%: Property tax (US average)

- 0.5%: Homeowner’s insurance (US average)

- 2.0%: Maintenance (Ballpark estimate of US average)

- 0.4%: Realtor fees (amortized over 13.3 years)

ALL THOSE EXPENSES paid, and the investment you get is a home which has appreciated at the rate of 3.7% over the last 30+ years (according to the S&P US Home Price Index). Meanwhile, US index funds are up more than 10% over that time.

That said, your primary home has one big advantage over index funds. You get to live in it! It’s really nice to have somewhere to live. I highly recommend it. But still. Financially speaking, the more modest your home (which keeps those expenses down!) and the more you invest outside your home, the wealthier you will be! :)

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy

via Instagram