Last night I had this great idea in the shower. I was going to make a post to illustrate the devastating impact of buying a house and selling sooner than five years. The crushing 6% realtor fee (huge relative to a 20% down payment), the missed opportunity cost of investing that down payment, the nefarious impact of taxes, insurance, maintenance, mortgage interest and closing costs. It would serve as an illustration of how the financial benefit of owning is really only reaped after many years of ownership.

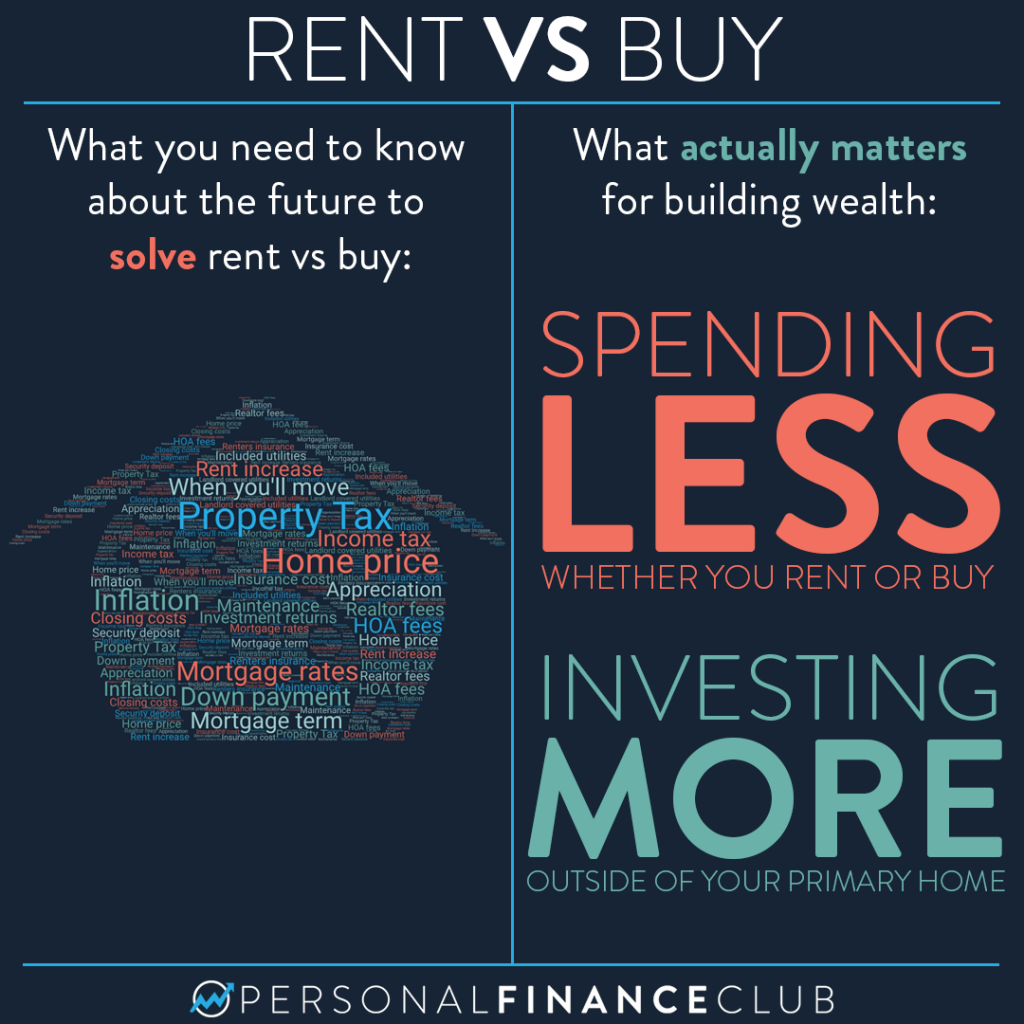

To make a fair comparison, I sat down and spent a couple hours on a spreadsheet, or what I like to call “a normal Tuesday night”. As I kept working, I kept realizing all the inputs necessary to really give a honest comparison of rent vs buy, even if you’re selling just 5 years later. How much you put down, your mortgage rate and term, the return you get if you invest the down payment, subsequent increases in rent, how much extra income you have to invest, inflation as it relates to maintenance, insurance, taxes, what utilities your landlord might cover. The list can go on and on.

I decided to lock in the cost of rent to the same as the mortgage PITI (principal, interest, taxes, and insurance). But even with that locked in, I could get the numbers to tell whatever story I wanted by slightly tweaking all the other speculative projections. (What if the market returns 8% instead of 10%? What if the home appreciates 4% instead of 3%?)

The more I played with it the more it dawned on me. There is no holy grail at the end of the rent vs buy debate. Once the dust settles you realize, whether you rent OR buy, it’s all about limiting your expenses and maximizing your investments. It’s the same two rules.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram