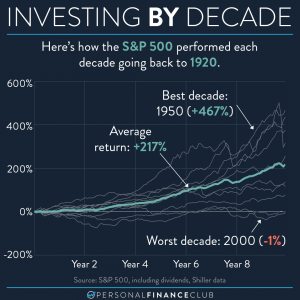

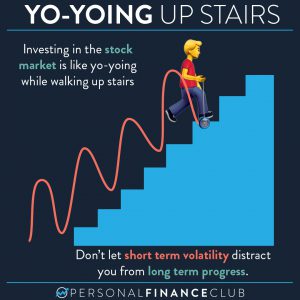

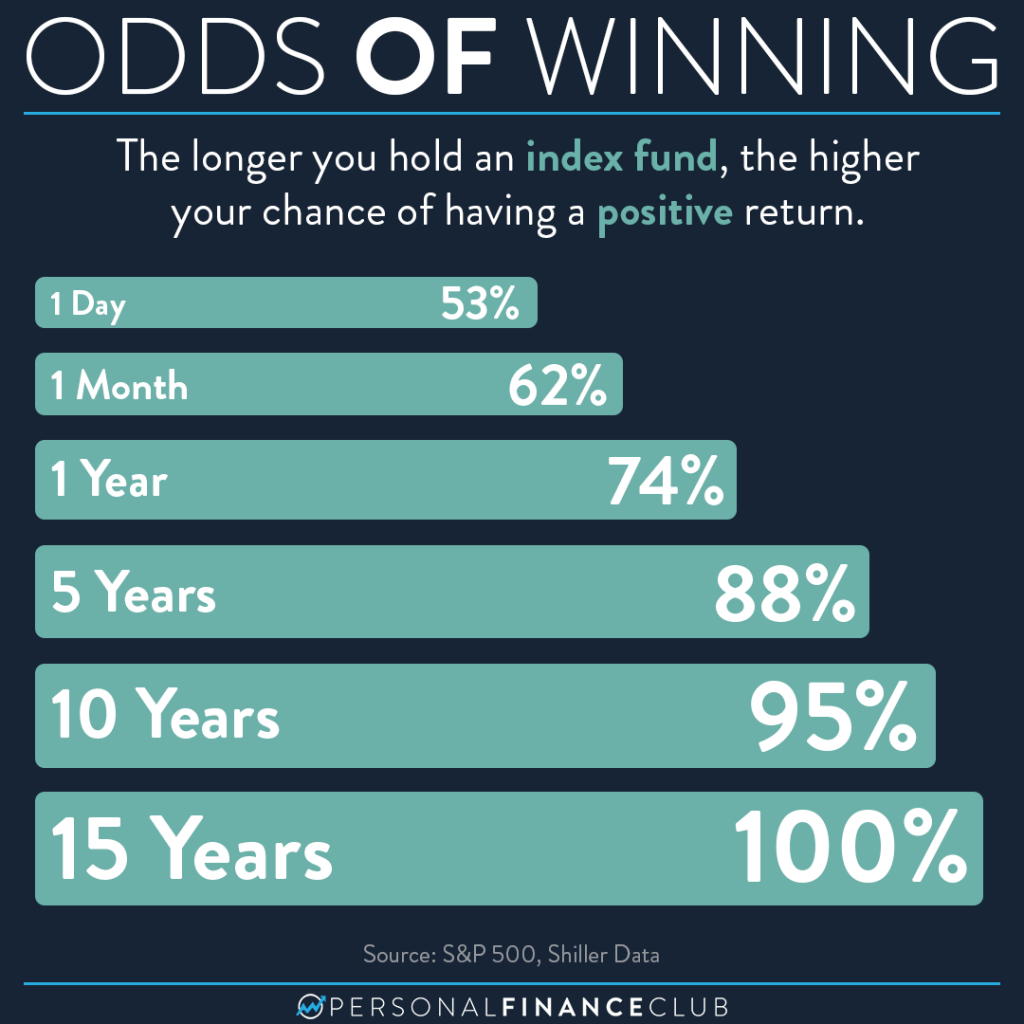

Sometimes new investors will buy an index fund and after three months ask, “why is my portfolio losing money?! Why is the market crashing??” Over such short periods of time, anything could happen when you invest. But as time goes on, that’s when the wealth creation process happens. Investing rewards those who are patient. And can punish those who try and time the market by buying and selling.

When we are saying a “positive return” in this post, we don’t just mean barely positive. The longer you hold, the higher the gain. In fact, in every 40 year period since 1900, investing $250/month in the S&P 500 would result in over $1 million. On average it’s $1.9 million.

There are plenty of people who try and guess what the stock market will do in the coming months. But that’s a fool’s game. Even the “best” investors in the world, with every resource at their fingertip, consistently fail at this. Don’t ever fall into the trap of playing this game. It can be tempting to try it, but it doesn’t work.

The best way to increase your odds of success when investing is to increase the length of time you remain invested in index funds. The longer you hold, the smaller any volatility in the market will look in the rear view mirror.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane

#stocks #investing #stockmarketinvesting #indexfunds #data #personalfinance #probability #barchart #learntoinvest #beginninginvestor #sandp500 #wealth