A three-fund portfolio is a simple way to diversify across the world’s stock and bond markets, and guarantee yourself your fair share of the full world’s market growth. It’s optimal investing with optimal simplicity.

What is a three-fund portfolio?

A three fund portfolio is an allocation of just three funds that make up an entire investing portfolio. They’re all you ever need to buy for the rest of your life. The three funds are:

- A total US stock market index fund

- A total non-US stock market index fund

- A total bond market index fund

Is there an easier way?

Yes, actually. You may be able to buy a single target date index fund. That’s a “fund of funds” that essentially holds a 3-fund portfolio inside of it. It’s the ultimate in simplicity and a single set-it-and-forget it option that will cover you for a lifetime of investing.

Who should use a 3-fund portfolio?

I believe there’s a real, positive financial value to simplicity. I believe you’ll be more rich if you invest more simply. So I lean toward a target date index fund when given the choice. But here are some reasons you might choose a 3-fund portfolio:

- Target date index funds aren’t available. For example, if you live outside of the US, you use a stock/ETF focused brokerage, or you’re picking funds inside of a 401k, you may not have access to a target date index fund. A 3-fund portfolio is an excellent alternative.

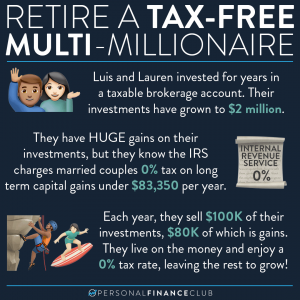

- You want to optimize tax efficiency. If you’re investing in both a taxable and tax-advantaged account, you may want to break apart your target date index fund into its components, so you can place the individual funds in a more tax efficient manner. (But weigh this potential tax benefit against the added complexity it introduces.)

- You want to customize. Maybe you don’t like the asset allocation glide path of a TDIF (i.e. you want to be more aggressive for longer) or you don’t want to glide at all. A 3-fund portfolio lets you pick your asset allocation yourself.

Which funds do I buy?

Keep in mind, that in general there is no “best index fund“. Any “total US stock market” index fund will perform virtually identically to all others. So when crafting your 3-fund portfolio, it’s not about picking the “best” index funds, it’s about picking the ones that are available, convenient, and as low fee as possible (avoiding transaction fees where possible).

First you might want to decide whether you will craft your 3-fund portfolio from index funds or ETFs. Again, both are equally good (although there may be a tiny marginal tax benefit to ETFs if held in a taxable account). I prefer the index fund version, because I find it more simple to invest in dollars than having to calculate how many shares to buy.

Once that choice is made, then you simply choose the funds that are available and low fee from your brokerage. When possible, you likely want to match your funds to your brokerage to avoid fees. i.e. buy Vanguard funds in a Vanguard account, Fidelity funds in a Fidelity account, etc. Below are some example ticker symbols.

Ticker symbols using index funds

If you’re using a brokerage that offers index funds with no transaction fees, you could consider the options below.

| Provider | Ticker Symbols (Expense ratio) |

| Vanguard | 🇺🇸: VTSAX (0.04%) 🌏: VTIAX (0.11%) 📜: VBTLX (0.05%) |

| Fidelity | 🇺🇸: FZROX (0.0%) 🌏: FZILX (0.0%) 📜: FXNAX (0.025%) |

| Schwab | 🇺🇸: SWTSX (0.03%) 🌏: SWISX (0.06%) 📜: SWAGX (0.04%) |

Ticker symbols using ETFs

Below are some sample three fund portfolios constructed using ETFs.

| Provider | Ticker Symbols (Expense Ratio) |

| Vanguard | 🇺🇸: VTI (0.03%) 🌏: VXUS (0.08%) 📜: BND (0.03%) |

| iShares | 🇺🇸: ITOT (0.03%) 🌏: IXUS (0.09%) 📜: AGG (0.04%) |

| Schwab | 🇺🇸: SCHB (0.03%) 🌏: SCHF (0.06%) 📜: SCHZ (0.03%) |

| Vanguard (Canada) | 🇺🇸: VUS (0.15%) 🌏: VEF (0.2%) 📜: VGAB (0.3%) |

How much of each do I buy?

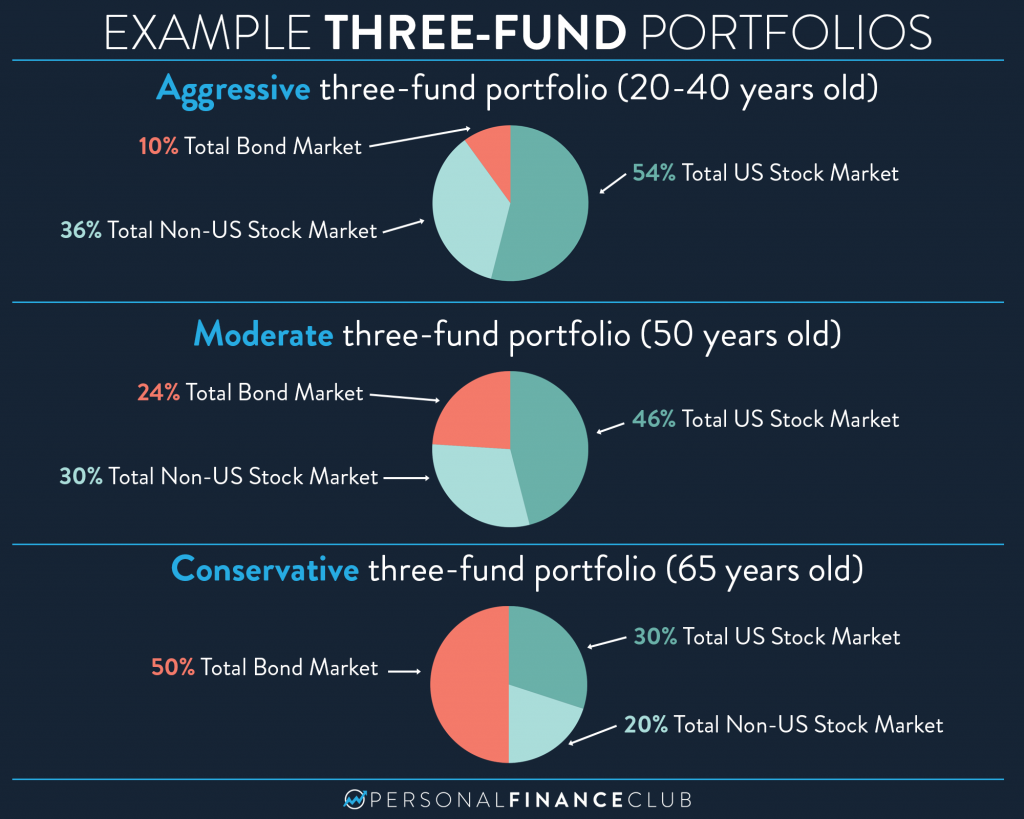

Choosing the proportion of each fund is called your “asset allocation”. A stock heavy portfolio is considered more aggressive, while a bond heavy portfolio is more conservative.

What you choose depends on your age and risk tolerance. I personally think “risk tolerance” is something you need to train yourself out of by understanding this historical volatility of the stock market. That means you can choose your asset allocation based on your age. Younger investors can seek higher returns through an aggressive portfolio (e.g. 90% stocks, 10% bonds), while older investors may wish to protect their capital with a conservative portfolio (e.g. 40% stocks, 60% bonds).

When choosing between US vs international, by market cap they’re about equally sized markets. i.e. the sum total of all US companies is about the same as the sum total of the rest of the world. Based on that, it would be absolutely fine to split US and international equally. Some US investors or otherwise US bullish investors prefer to overweight US stocks (or even eliminate the international portion), based on a belief the US brand of capitalism will lead to future outperformance. Vanguard says to go with 40% international.

Ok, so how much at which age?

If we key off the Vanguard target date index funds, we get a table like this:

| Age | % US | % Non-US | % Bonds |

| 20 | 54% | 36% | 10% |

| 25 | 54% | 36% | 10% |

| 30 | 54% | 36% | 10% |

| 35 | 54% | 36% | 10% |

| 40 | 54% | 36% | 10% |

| 45 | 50% | 33% | 17% |

| 50 | 46% | 30% | 24% |

| 55 | 41% | 27% | 32% |

| 60 | 36% | 24% | 40% |

| 65 | 30% | 20% | 50% |

| 70 | 21% | 14% | 65% |

| 75+ | 18% | 12% | 70% |

Putting it all together, a case study

This is Tiffany. She wants to invest simply and optimally for her future so she decides on a three-fund portfolio. Her brokerage account doesn’t offer index funds, so she decides on an ETF portfolio. She goes with Vanguard ETFs based on their great reputation for index fund investing.

She’s 35 years old and has $10,000 to invest. So in her brokerage account she makes three purchases based on the above tables:

- Buy 32 shares of VTI (About $5,400, 54% of her portfolio)

- Buy 70 shares of VXUS (About $3,600, 36% of her portfolio)

- Buy 11 shares of BND (About $1,000, 10% of her portfolio)

Tiffany sets up auto-contributions each month in the same proportion, to meet her target asset allocation (54%/36%/10%).

When Tiffany gets a bonus, she makes bigger contributions, and uses an simple spreadsheet to determine how many shares of each ETF she needs to buy to stay on track with her target asset allocation.

As she passes 40, and 45, she will tweak her auto-contributions and her spreadsheet to match her new target asset allocation based on the above table.

Tiffany continues to invest early and often throughout her career, and never sells anything until she retires. She has mastered investing and her portfolio has outperformed the vast majority of her peers!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy