The phrase “renting is throwing money away” is really dumb. Why don’t we say that about other stuff? Let’s try it. “Buying groceries is throwing money away”, “Paying your phone bill is throwing money away”, “Putting gas in your car is throwing money away.” SEE? It sounds dumb. Shit costs money, yo.

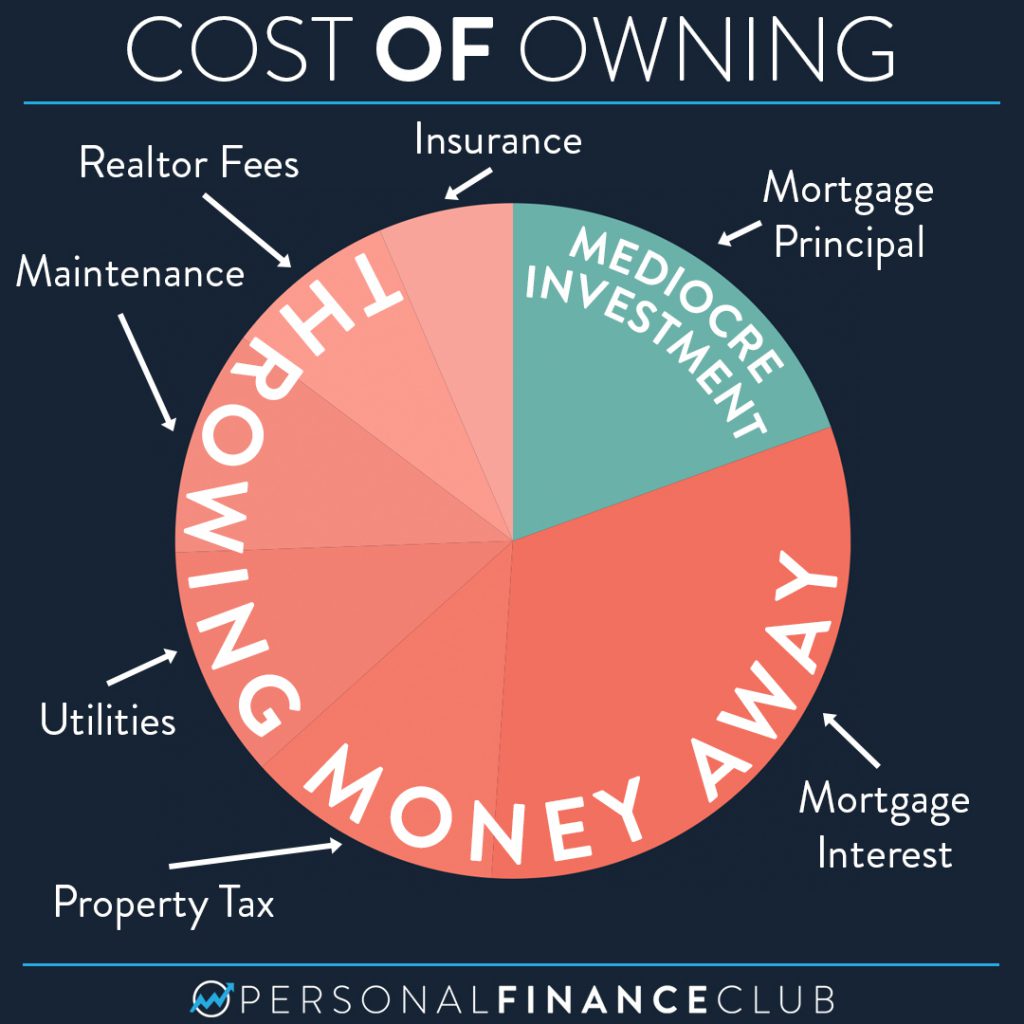

But sure, the implication is “owning a home is NOT throwing money away because you get to keep the home when the mortgage is paid off”. On first glance that logic seems solid. But take a look at this pie chart. When you own a home, on average, about 80% of your money is going to totally sunk costs. “Throwing money away” in the exact same way that renting is. And for the entry cost of 80%, the other 20% goes to a mediocre investment. The average “same home sales price” has increased about 4% per year over the last 40 years, just barely outpacing inflation.

If you’re thinking, “but all things equal, isn’t it better to have that 20%?”. Maybe. But, all things are rarely equal. i.e. if your rent is only 60% of the total monthly cost of homeownership, all things aren’t equal. How could rent be cheaper? Aren’t you just paying someone else’s mortgage? Because people often rent frugally and buy lavishly. For example, a renter might live in an apartment that takes advantage of the economy of scale of many units on the same property. But when they buy, they upgrade to a house and take on a whole host of additional costs.

From a purely financial perspective, sometimes owning is better, sometimes renting is better. It depends on the property, the location, your financial situation, how long you live there, etc. And maybe the biggest factor in this choice is whether you even WANT to be a homeowner. Renting doesn’t represent a failure of some sort. And owning doesn’t mean you’ve won. Spending less on your home and investing more is how to win with money.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram