A crash is coming – here’s what you need to know.

A stock market crash is coming. I’m sure of it. The problem is, I don’t know when. It could start tomorrow, or it could start

A stock market crash is coming. I’m sure of it. The problem is, I don’t know when. It could start tomorrow, or it could start

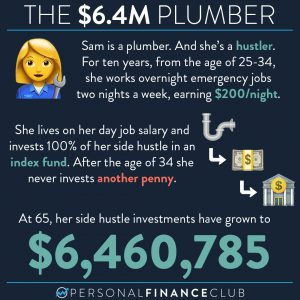

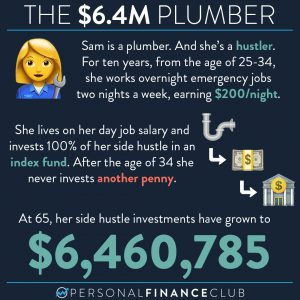

Sam’s a hustler and she’s not normal. Normal is ramping up your lifestyle to match your income. Sam went the other direction. She went HAM

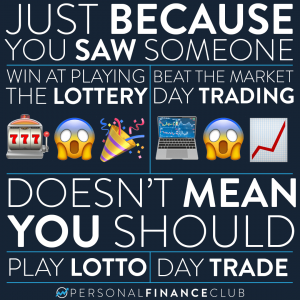

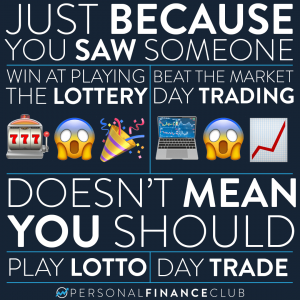

The message here isn’t: “You’re not as smart as those other day traders, so don’t try”. The message IS: “We expect randomness to occur in

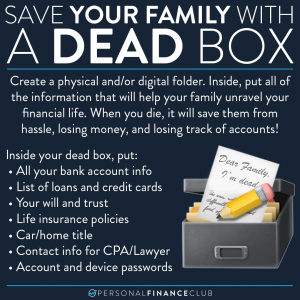

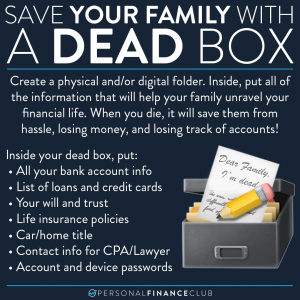

I hate to be the bearer of bad news, but you’re going to die. We all are. In just 100 years EVERYONE READING THIS

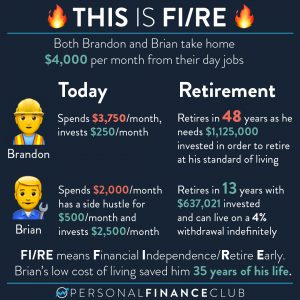

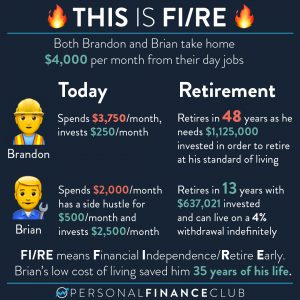

Let me be clear: Brian is not normal. He doesn’t use his money like anyone else around him. He rarely buys clothes, but when he

When you make millions of dollars a year, it doesn’t mean you’re financially set. Lifestyle creep affects people at all income levels. MC Hammer’s 40,000

Job Status (Check here for updates): This position has been filled and we are no longer accepting applications. Nectarine is seeking our first employee! We

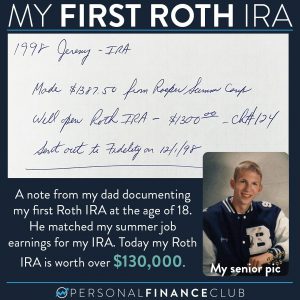

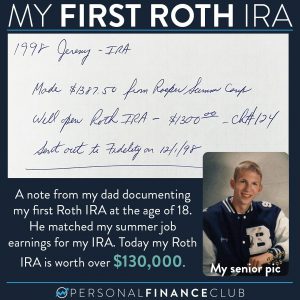

Happy Father’s Day to my dad and all the dad’s out there who help teach their kids about money! My dad was the first person

People are so weird about cars. So many of us otherwise frugal, rational, human beings become financially INSANE when it comes to cars. At the

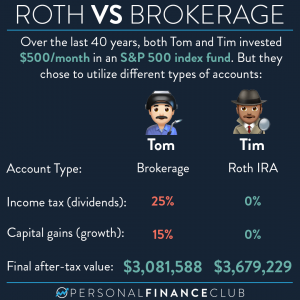

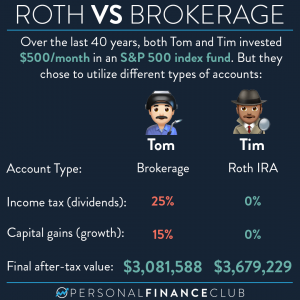

There are a few important takeaways here. First, if you invested $500/month in an index fund over the last 40 years you would be very

A stock market crash is coming. I’m sure of it. The problem is, I don’t know when. It could start tomorrow, or it could start

Sam’s a hustler and she’s not normal. Normal is ramping up your lifestyle to match your income. Sam went the other direction. She went HAM

The message here isn’t: “You’re not as smart as those other day traders, so don’t try”. The message IS: “We expect randomness to occur in

I hate to be the bearer of bad news, but you’re going to die. We all are. In just 100 years EVERYONE READING THIS

Let me be clear: Brian is not normal. He doesn’t use his money like anyone else around him. He rarely buys clothes, but when he

When you make millions of dollars a year, it doesn’t mean you’re financially set. Lifestyle creep affects people at all income levels. MC Hammer’s 40,000

Job Status (Check here for updates): This position has been filled and we are no longer accepting applications. Nectarine is seeking our first employee! We

Happy Father’s Day to my dad and all the dad’s out there who help teach their kids about money! My dad was the first person

People are so weird about cars. So many of us otherwise frugal, rational, human beings become financially INSANE when it comes to cars. At the

There are a few important takeaways here. First, if you invested $500/month in an index fund over the last 40 years you would be very