1. Live below your means

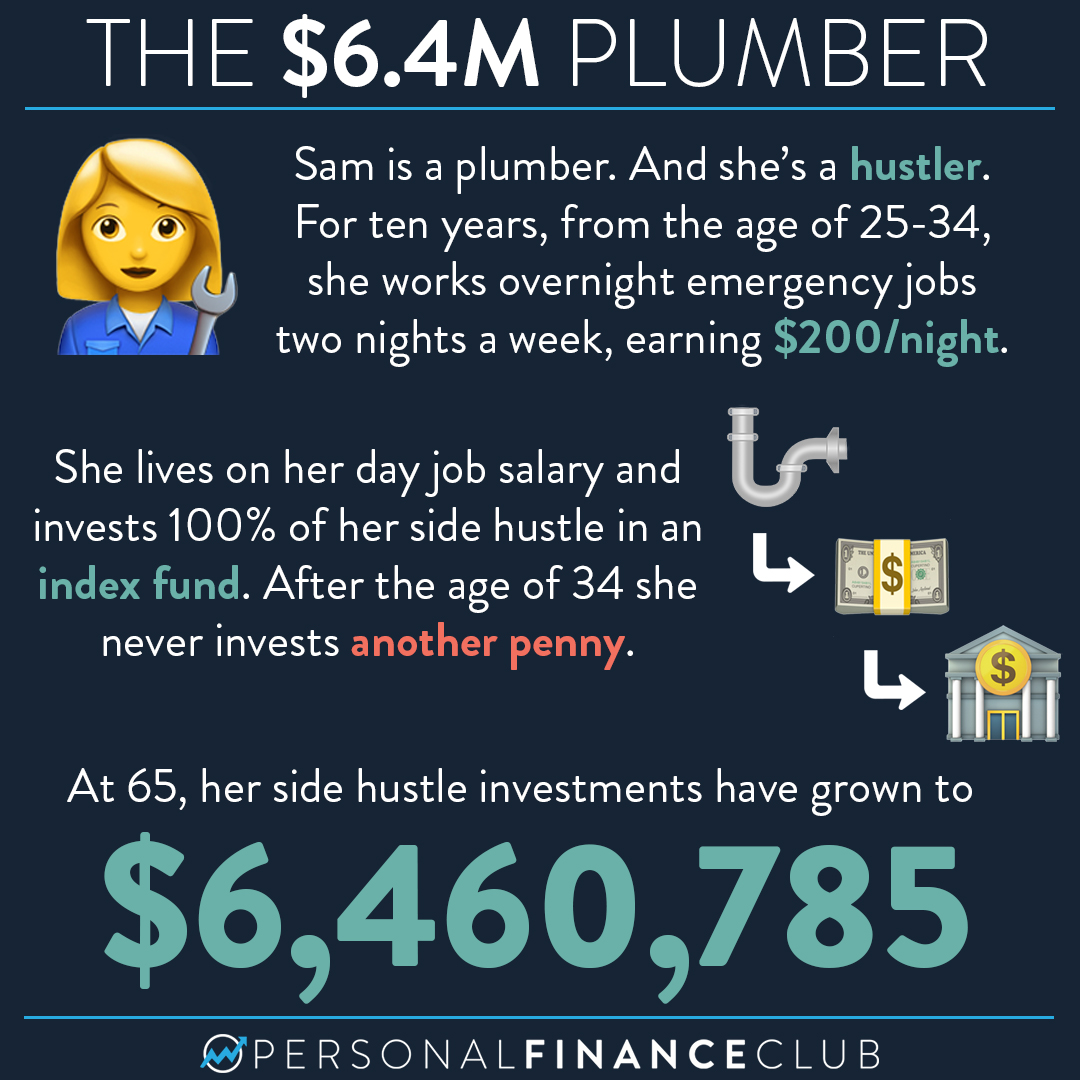

2. Invest early and often

Our investing method is simple: set it and forget it. But HOW?

You’ll learn which accounts to invest in, which index funds to buy, which buttons to click, and so much more.

After that, watch your money grow to become a million dollars.

I’m a programmer aka nerd. So I made these fun tools to help you understand investing better.

I’m a programmer aka nerd. So I made these fun tools to help you understand investing better.

Hi! I’m Jeremy. I retired at 36 and currently have a net worth of over $4 million.

The world of money and investing is confusing. There’s a multi-trillion dollar financial services industry ready to take advantage of you. But financial literacy can help you navigate this world of money.

Personal Finance Club is here to give simple, unbiased information on how to win with money and become a multi-millionaire!

Use this contact form for customer service and business inquiries.

If you have questions about money, you can get help here.