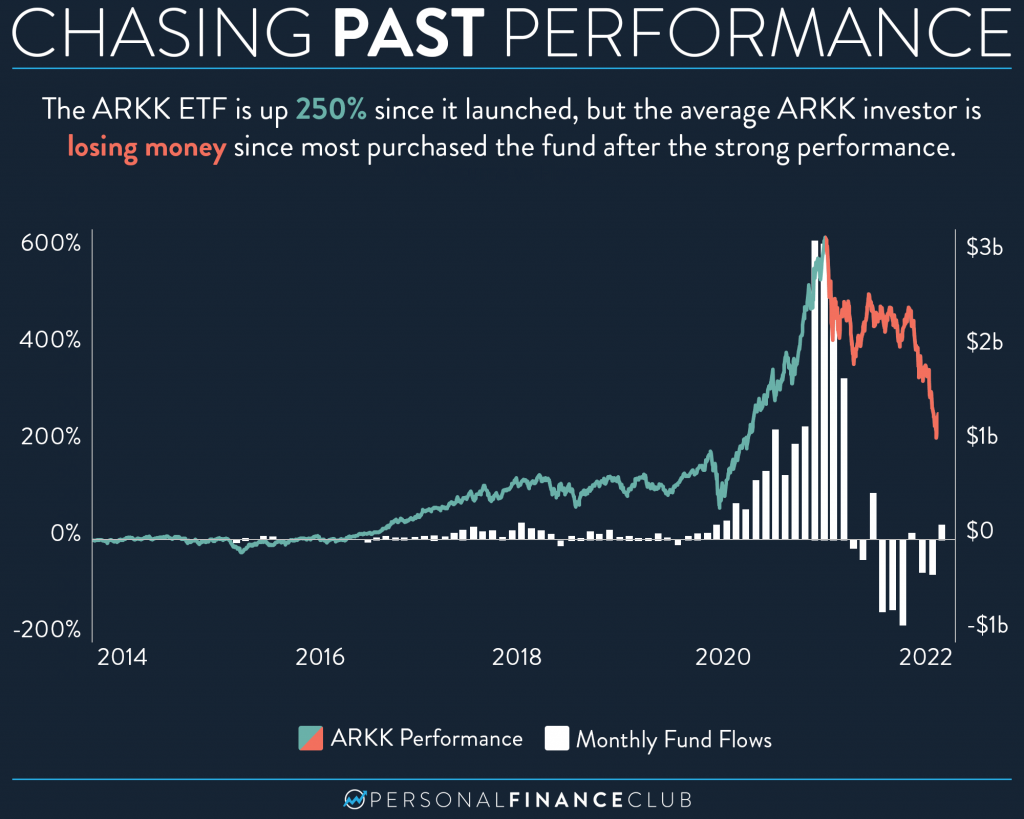

If you’re not familiar, the ARKK ETF is an actively managed fund managed by Cathie Wood. About a year ago, it was the hottest thing on Wall Street. I had tons of people writing me, telling me I was dumb for not understanding the future of technology and the brilliance of Cathie Wood. I asked them if they had been investing with her for years, or just started recently. Guess what the answer was.

Let’s look at how ARKK has done. Despite generating +250% returns since its launch, the average investor in Cathie Wood’s flagship fund is actually losing money. The vast majority of money flowed into the fund after the massive run up. This is a perfect example of the danger of chasing past performance. It’s also a good example of how investor returns can differ from fund returns in a meaningful way. (e.g. Bitcoin may be up a zillion percent from 10 years ago, but how do you think the average bitcoin investor is doing?)

Most investors bought in early 2021 when the fund raised $9 billion in three months alone. The peak of performance was February 2021. At one point ARKK was a $30 billion dollar fund. Today it has $12 billion. ARKK investors have personified buying high and selling low.

At the peak a year ago, the ARK fund was outperforming the NASDAQ by 400% since the fund’s inception. Cathie Wood was viewed as one of the best portfolio managers of this generation. Fast forward to today and the fund is down 55% from its peak and is now underperforming the NASDAQ since inception.

Cathie Wood wasn’t the first wunderkind portfolio manager annointed by Wall Street as visionary. She also won’t be the last. Because there are lots of investors doing lots of different things we KNOW that some will (at least temporarily) outperform the market. That’s just due to variance and randomness. But jumping on the bandwagon is a good way to underperform the market.

Be an investor, not a speculator.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

p.s. Thanks to @shane_sideris for the great research and creation of this post!

via Instagram