The whole topic of insurance can be nerve-racking and guilt inducing. It can feel like you’re not doing it right and you’re delinquent for getting it wrong.

But let’s put the guilt aside and look at what insurance REALLY is. It’s a way to pay a small amount of money periodically to help cover the financial implications if something big and bad happens. Note that it’s impossible to get insurance “perfectly right”. To do that would require knowledge of the future. For example, if I KNEW I would never get in a car accident, then I would simply not pay for any auto insurance (other than what’s required by law).

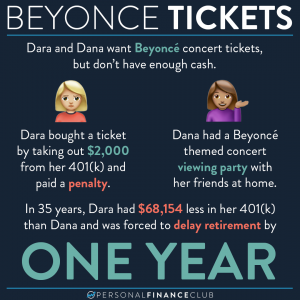

When thinking about buying insurance, you want to balance making sure the extreme bad thing doesn’t ruin you while also minimizing your monthly premium payments. If your goal is to NEVER be financially responsible for ANY bad thing, you will end up buying WAY TOO MUCH insurance and end up financially worse off than if you saved/invested some of that insurance money. On the flip side, if you have NO coverage, it leave you susceptible to the unexpected disaster which could leave you in even worse shape.

That’s how I think about car insurance. For new or expensive cars, I really don’t want to be on the hook for $30K+ if my car gets totaled so I’m willing to pay the ~$75/month to prevent that bad thing.

For clunkers, the math is a little different. For six years in my 30s I drove a 1999 Ford Explorer Sport. I paid $3,000 for it. If I were to buy collision and comprehensive insurance on it, it would have cost me maybe $50/month or $600/year. That means I’m basically paying the ENTIRE cost of the car every five years. PLUS that insurance includes a “deductible”, meaning I’m making a $50/month bet that I’m going to have more than $500 of damage to a <$3,000 car every few years. I chose to save/invest that $50 and simply take the loss if my clunker gets totaled.

p.s. We’re having our FIRST EVER free webinar on INSURANCE tomorrow evening at 5pm PT, 8pm ET. We’ll talk about this and more. Sign up at my link in bio!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!