Bear markets are normal. Freaking out isn’t a strategy

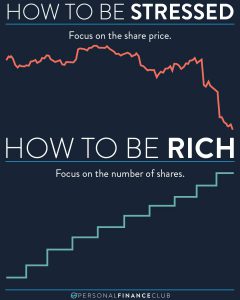

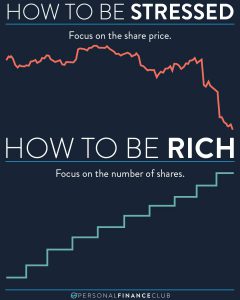

AS I WRITE THIS, the market opened up way down, dropped more well into bear market territory but now is UP about 1% from it’s

Sign up to be notified of our Dead Box launch on 6/16/2025!

Sign up to be notified of our Dead Box launch on 6/16/2025!

AS I WRITE THIS, the market opened up way down, dropped more well into bear market territory but now is UP about 1% from it’s

I get it. It’s scary to check your investment accounts and see the value go down. I’m personally down over a quarter million bucks over

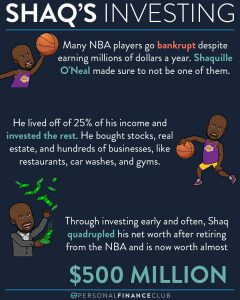

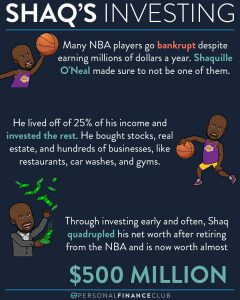

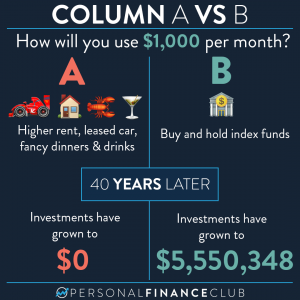

When Shaq got his first million dollar check at age 20, he spent it ALL in one day. He quickly learned that his life would

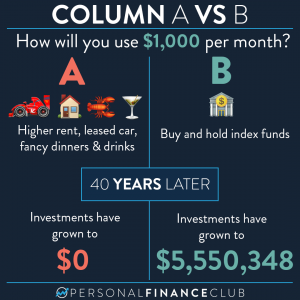

When I post stuff like this, it’s not about shaming spending money on things that you like. I believe the goal of money is to

Put away that lucky coin. Forget the tracking whether Venus is in retrograde. Keep that magic 8-ball collecting dust in the closet. Because it’s official.

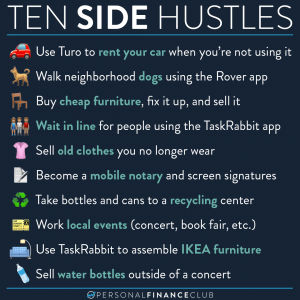

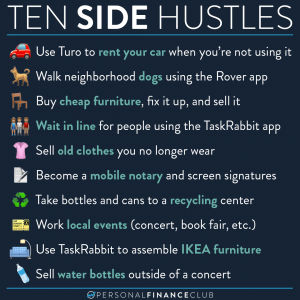

Side hustles don’t have to be complicated or elaborate. Better yet, there is something out there for everyone regardless of your skills, interests, and how

I’ll admit, I really like talking about that long list on the right. In fact, most of my posts are about them. They’re academically interesting.

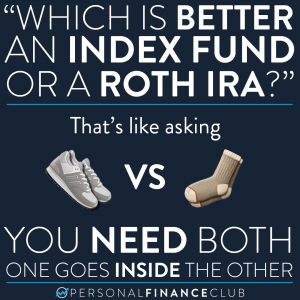

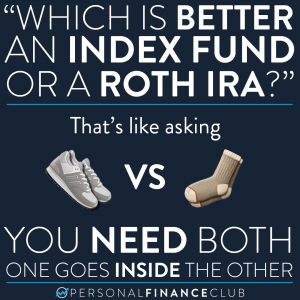

When I’m out in public I often get this question from fans who recognize me. It usually goes something like this: “So I’ve heard Roth

Saving money to spend in the distant future may sound terrible because tomorrow isn’t guaranteed and we should get to enjoy the life that we

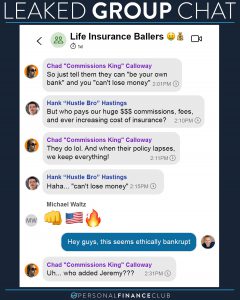

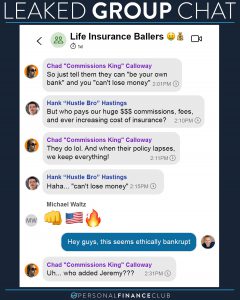

I do NOT know how I got on this group chat. They say it’s not classified though, so I guess we’re all good. A quick

AS I WRITE THIS, the market opened up way down, dropped more well into bear market territory but now is UP about 1% from it’s

I get it. It’s scary to check your investment accounts and see the value go down. I’m personally down over a quarter million bucks over

When Shaq got his first million dollar check at age 20, he spent it ALL in one day. He quickly learned that his life would

When I post stuff like this, it’s not about shaming spending money on things that you like. I believe the goal of money is to

Put away that lucky coin. Forget the tracking whether Venus is in retrograde. Keep that magic 8-ball collecting dust in the closet. Because it’s official.

Side hustles don’t have to be complicated or elaborate. Better yet, there is something out there for everyone regardless of your skills, interests, and how

I’ll admit, I really like talking about that long list on the right. In fact, most of my posts are about them. They’re academically interesting.

When I’m out in public I often get this question from fans who recognize me. It usually goes something like this: “So I’ve heard Roth

Saving money to spend in the distant future may sound terrible because tomorrow isn’t guaranteed and we should get to enjoy the life that we

I do NOT know how I got on this group chat. They say it’s not classified though, so I guess we’re all good. A quick