The popular debate of “rent vs buy” ignores the much bigger question: How MUCH should you spend on your primary residence, whether you rent OR buy?

To illustrate this point, I’d like to tell the story of my two emoji friends, Morgan and Hannah.

They both bought a home in 1989, exactly 30 years ago. And they both had identical assets at the time and identical incomes their whole careers. Specifically both Morgan and Hannah had:

- $30,000 in cash

- $2,000/month available for housing and investing

Where they differed was in how much house they bought.

Morgan bought a mansion. Morgan believed real estate was a great investment, so she went big. She bought a house for $150,000, the biggest house she could afford, believing it would go up in value. She used all $30,000 as a 20% down payment and took out a mortgage for the remaining $120,000.

Hannah bought humbly. Instead of buying the biggest house possible, Hannah bought a more humble home with a lower down payment and lower monthly mortgage payment. Hannah bought a $75,000 house putting 20% or $15,000 towards the down payment and getting a mortgage for the other $60,000.

Invest the rest. Both Morgan and Hannah are believers in investing as well. So after all their housing expenses were paid from their budget, they invested the rest in an S&P 500 index fund. Hannah also dumped her remaining initial $15,000 in an S&P 500 index fund in 1989.

Real estate did great. Both of their homes more than doubled in value over the last 30 years. They both increased by the US average over that time, gaining 3.5% per year, and are now worth $415,587 and $207,794 respectively.

The devil is in expenses. While the home values both went way up, they also had to pay the expenses of homeownership along the way. Those expenses scaled with the cost of their homes, so Morgan ended up paying a lot more. Here’s a look at the breakdown of their monthly expenses and what was left to invest.

Monthly Expenses:

| Morgan ($150K home) | Hannah ($75K home) | |

| Monthly Budget | $2,000 | $2,000 |

| Mortgage | $743 | $371 |

| Insurance | $111 | $56 |

| Maintenance | $589 | $295 |

| Property Tax | $285 | $143 |

| Total Monthly Cost | $1,729 | $864 |

| Left to invest in S&P 500 | $271 | $1,136 |

Hannah indexed more. As you can see due to the lower cost of living, Hannah was able to invest more in the S&P 500 index fund every month.

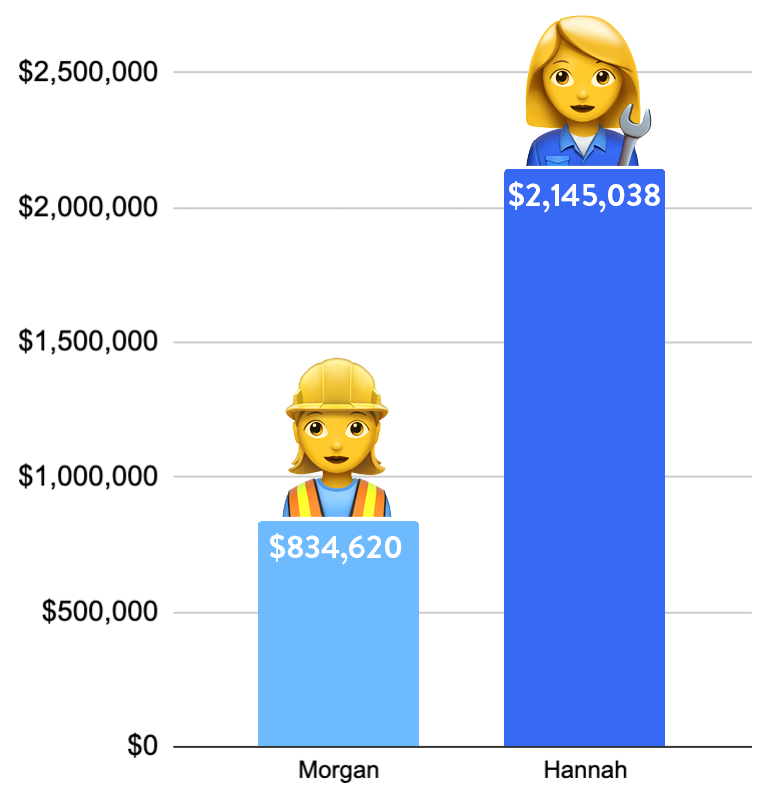

Stocks did even better. Over the last 30 years the stock market is up about 9.5% per year. That means Morgan’s $271/month investment grew to an impressive $419,032. But Hannah really did great. Her $15,000 lump sum plus $1,136 monthly investment grew the stock portion of her portfolio to a whopping $1,937,244.

How it shook out. Both women invested their whole $2,000/month in their primary home and the US stock market. But because Morgan bought twice as much house, she was saddled with twice as many home-related expenses. That means higher expenses AND more of her principal payments going into an asset returning 3.5%. Meanwhile, Hannah kept her sunk costs lower, and was putting more of her income into the stock market returning 9.5%. After 30 years, despite identical starting cash and monthly investments, Humble Hannah ended up over 2.5X more wealth than Morgan in her mansion.

The forced savings account. You often hear that your primary home is an investment. That’s true, but it’s more akin to a forced savings account with a negative return. Over the 30 years each of my friends owned their homes they both paid in 1.5X the home’s final worth in total payments. So while they were paying down the principal on that loan, the net result after expenses was effectively a savings account paying -1.5% interest per year. That doesn’t mean buying is bad. Your primary residence is an expense however you live. But don’t fall into the trap of believing a bigger home is a better investment.

The cost of a bigger home. Every $1 more spent on a house in 1989 in lieu of investing in the stock market made the buyer $17 dollars less wealthy in 2019.

Details for nerds. If you money nerds want to check my math or play with the numbers yourself, check out the buy vs buy calculator as a google sheet. Check the notes in the google doc for links to all the references used in this article.

September Sale!

September Sale!