YES I KNOW, you can’t live in an index fund (much to my dismay). FURTHERMORE, I also know that renting costs money (what does renting have to do with this?!)

But let me suggest a radical idea to you: ✨✨✨NOT ALL HOMES COST THE SAME AMOUNT OF MONEY✨✨✨

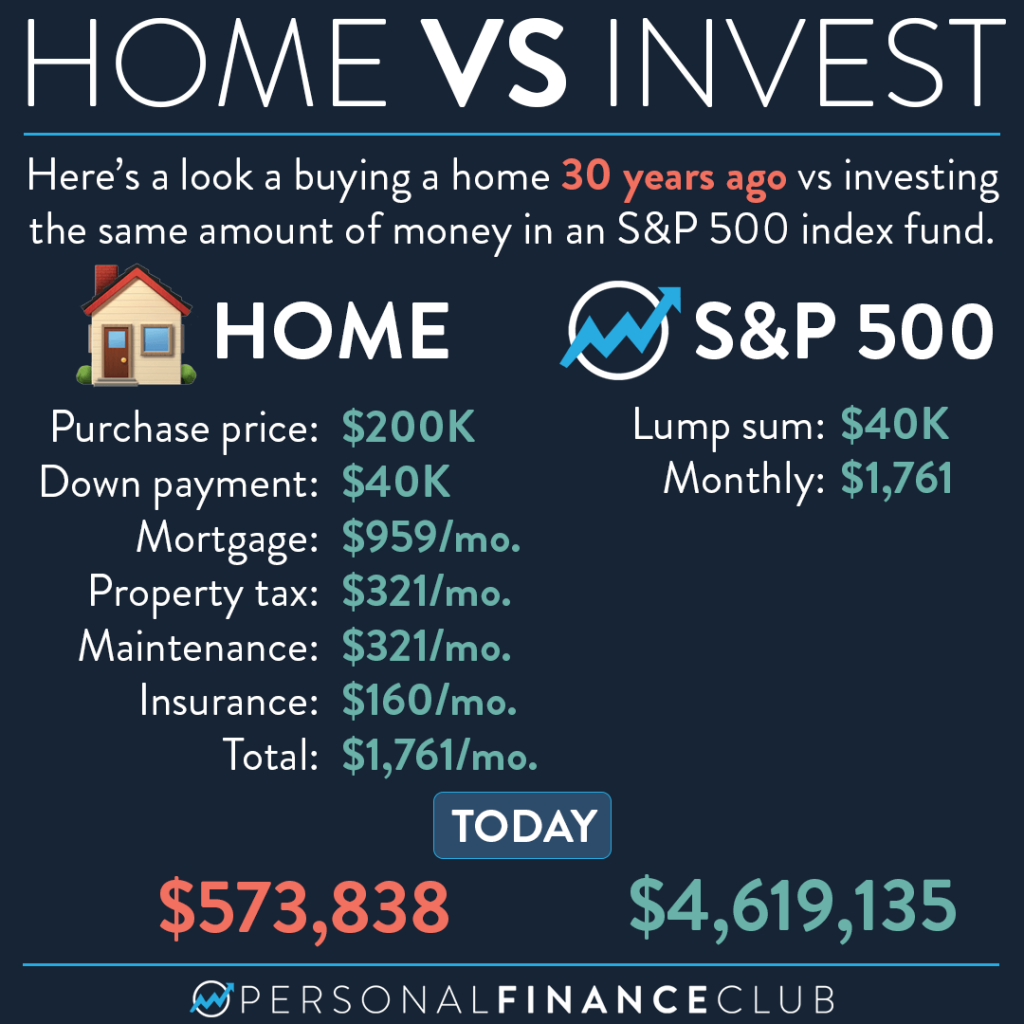

When you’re choosing where to live (rent or buy) you’re making the biggest spending decision of your life. And spending more money on your primary residence means less money available for a much better performing asset, like index funds or investment real estate!

What if you were able to reduce your primary home expense by 50% (by downsizing, house hacking, etc) and invest half that housing payment. That one move alone could result in millions of dollars over the course of your career! Worth it? Maybe! You get to make that call. I’m just some crackpot on instagram throwing out wild ideas trying to create turmoil in the comments. It’s your life. But the math is sound.

Speaking of sound math and turmoil in the comments, if you’re questioning where all those housing expenses came from, this is how I estimated the cost:

The average mortgage rate for a 30 year fixed in 1991 was 9.25% (ouch!). For this example, I used a generous 6% rate, giving the homeowner credit for a couple zero-cost refinances along the way. The property tax and maintenance both represent 1% per year of the average value of the home over those 30 years. Don’t think maintenance costs that much? Go remodel one room in your house and say that to me again with a straight face. And you need to do those remodels if you want to realize the appreciation of your home (no one wants a 30 years out of date house). I estimated insurance at 0.5% per year of the average home value. I didn’t even count realtor fees or those refinance expenses against the house!

So when you’re deciding on housing and investing, consider doing less on the left column and more on the right column. It could make you a millionaire.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram