If you’ve read my posts before, you know I end every post by mentioning my two rules of building wealth:

1.) Live below your means

2.) Invest early and often

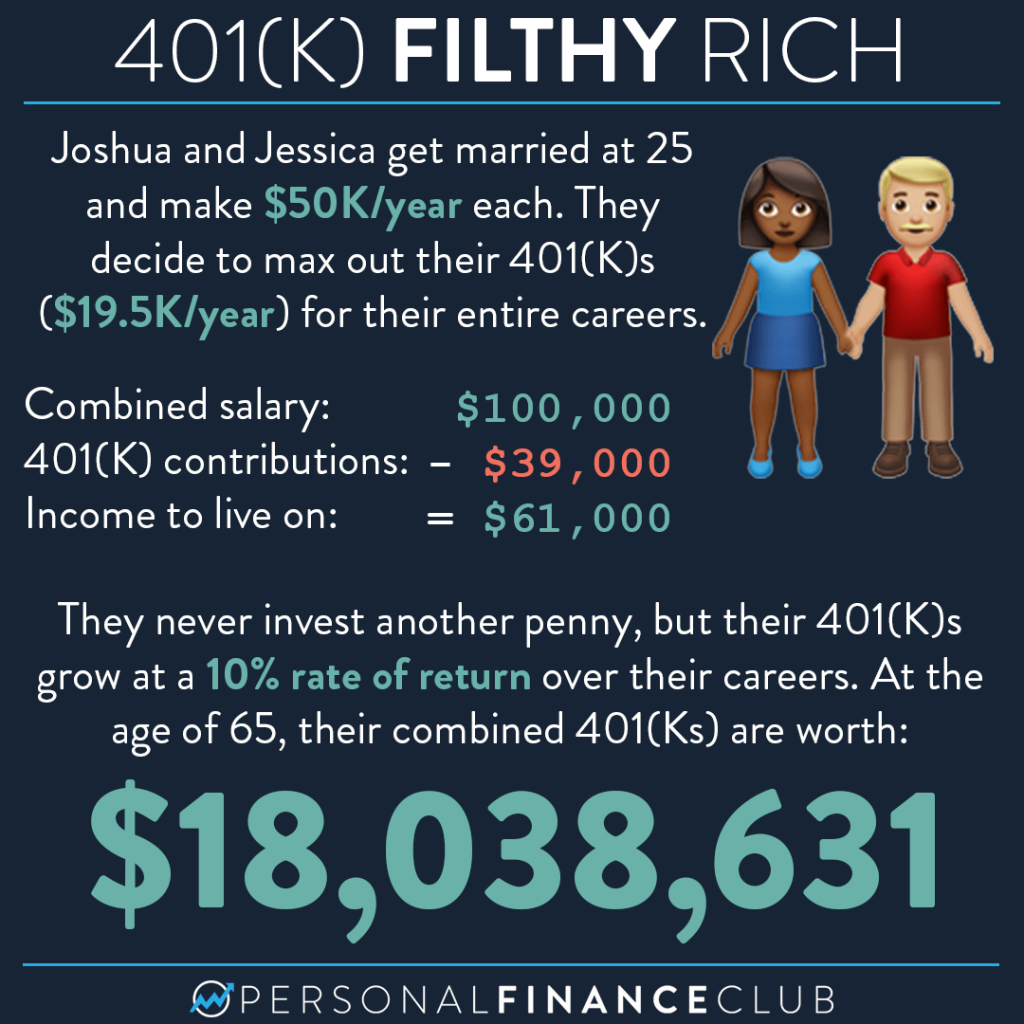

Well, this is what it looks like in a nutshell. It’s nothing fancy. No bizarre investing strategies. No big inheritance or dotcom windfall. No universal life insurance policy or MLM scheme. This couple simply made the ambitious decision to max out their 401(k)s as their sole investment avenue. And at retirement age they’re worth over $18M bucks.

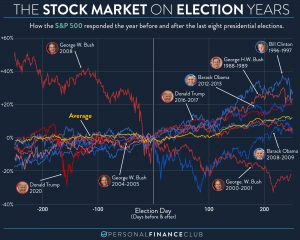

For those who say 10% isn’t realistic, the S&P 500 has returned about 11.5% over the last 40 years.

This, however, doesn’t take into account the impact of inflation. If you assume inflation is going to eat away 3% of the spending power every year, the spending power of their account falls to about $6.5M in today’s dollars. That said, this scenario also doesn’t take into account any raises or increases in their contributions. So it could very well be more than that. Plus $6.5M is already a lot of cheddar.

If your company doesn’t offer a 401(k), that’s ok! Start with a Roth IRA. You can also invest an unlimited amount in a regular brokerage account. If you’re new to investing you can check my “How to invest” story highlight, my other posts, or check out my course where I walk through all the steps.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

– Jeremy

via Instagram