The S&P 500 is up over 23% so far this year! When the market is up, people inevitably say that a crash is coming. When the market is down, people inevitably say that a crash is coming. But here’s the truth. The market USUALLY goes up.

The market went down last year? Most likely it will go up next year. The market went up last year? Most likely it will go up next year. About 70% of years the market is up and 30% the market is down. If we KNEW AHEAD OF TIME when the down years where coming, we’d exit the market and wait for the upswing. Unfortunately we don’t, so the best practice is to simply do nothing. Buy and hold. Keep buying. Never sell until you retire.

Over the last 100 years if you held through all the booms and busts, you’d average about a 10% annualized return per year. 10% in compounding growth has the magical ability to turn a little bit of money invested regularly into HUGE sums.

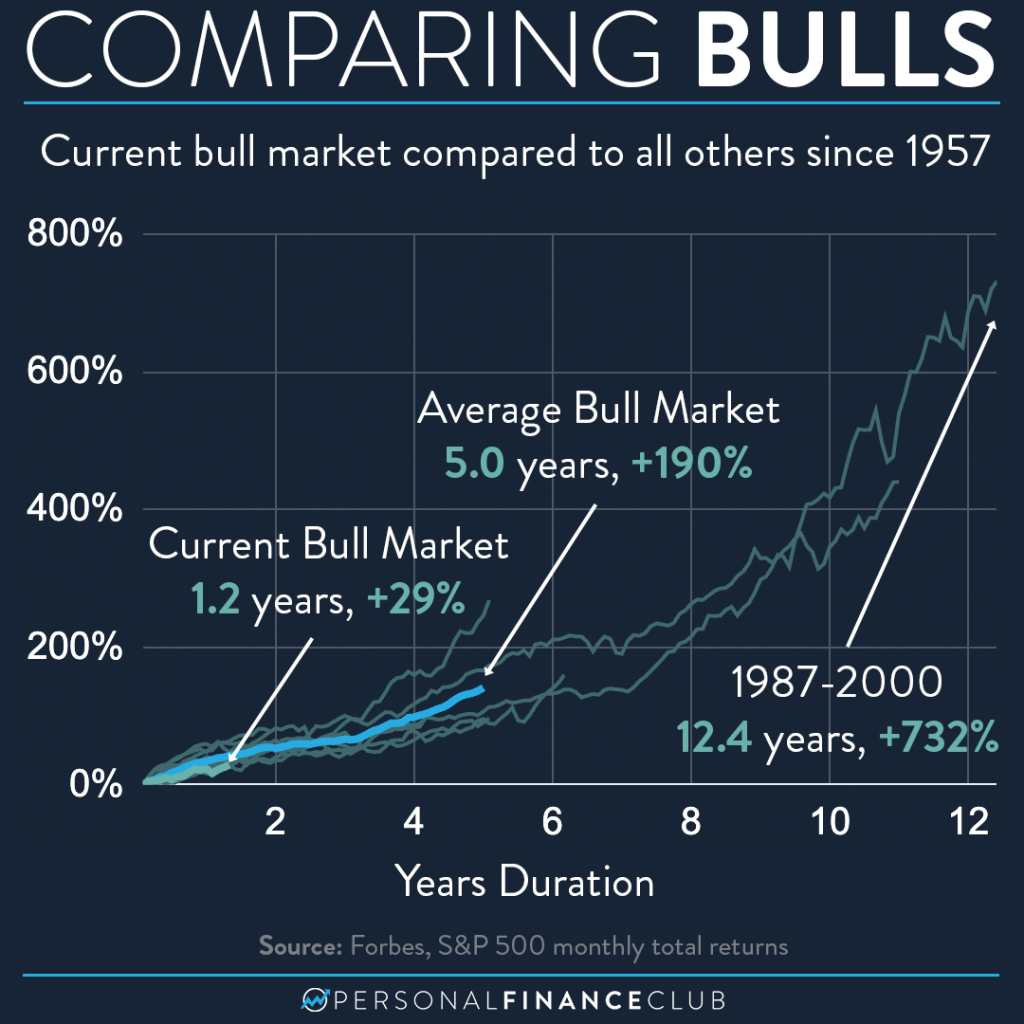

We’re currently enjoying a nice bull market run! Does that mean it’s going to end soon? Historically, probably not. We’re about 1.2 years into it and the market is up 29%. Of the 11 other bull markets since 1957, the average duration has been 5 years with an average gain of 190%. If we expect the average this time, +29% is barely getting started.

If you add up all that bull market time since 1957 it adds to over 56 years. And total time elapsed since 1957 is 66 years. That means we’re enjoying a bull market about 85% of the time. So why do the CRASHES make so many headlines? First, because they’re unusual. Dog bites man isn’t a story, man bites dog is the story. Market goes up isn’t a story, market crash is! Plus, people and news love FEAR. You can make headlines predicting a scary crash. But espousing the benefits of buy and hold investing is hardly going to attract clicks. (But it will attract dollars)

So stay the course my friends! Keep buying and holding index funds.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!