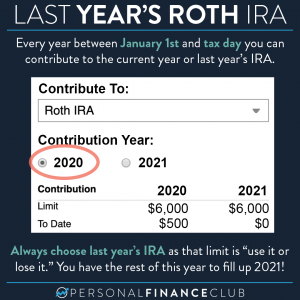

I have a friend that I’ve been helping with her Roth IRA for about 10 years. A couple of nights ago we had our annual “invest in her Roth IRA” meeting. We started by transferring money from her checking account into her Roth IRA. At this point in the night, she said, “Oh if it was that easy I could have done it on my own.” I think my exact response was “FOR THE LOVE OF GOD WE’RE NOT DONE YET BECAUSE YOU HAVE TO INVEST THE CASH AFTER IT’S CONTRIBUTED TO THE ACCOUNT”. Then I flipped the table over in rage and stormed into the corner to cuddle with my Jack Bogle plushy.

But seriously, this is the #1 most common, and most devastating problem I see from newer investors. Holding cash in investment accounts. Use this guide to figure out if you’re making this mistake. Putting cash in an investment account alone doesn’t do anything! You have to take the second step of using that cash to BUY an investment (like an index fund!)

Friends don’t let friends hold cash in retirement accounts. Please spread the word.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram