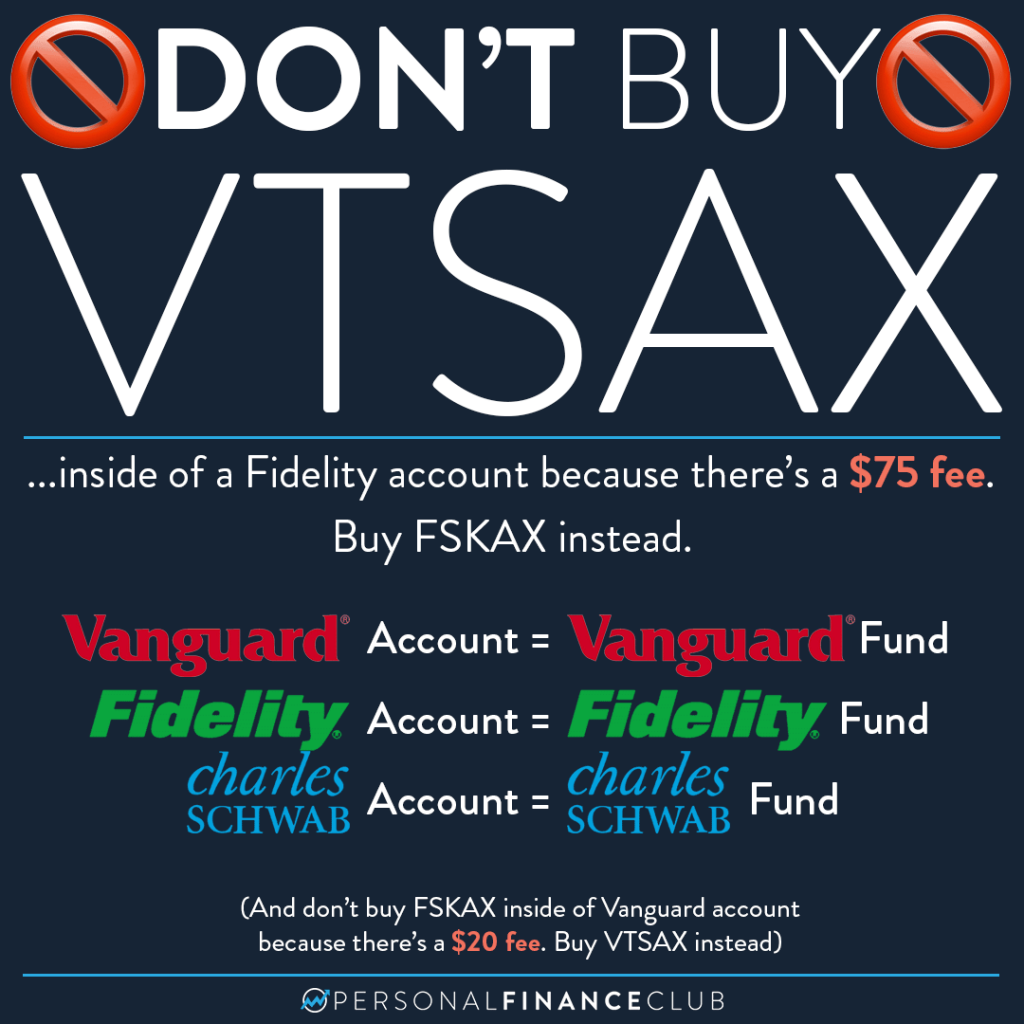

This is one of the most common mistakes I see among newer investors. Getting it right might save you $75 EVERY TIME you buy or sell.

When you’re buying MUTUAL FUNDS, make sure you only buy “no transaction fee” funds. I NEVER pay a transaction fee. That generally means you’re matching the fund to the brokerage you’re with. So if you own VTSAX (one of the world’s most popular index funds) inside of a non-Vanguard account, you’re getting hit with a fee every time you buy or sell!

What do you do instead? Buy the version of the fund provided by the brokerage you’re using. For example, the three major brokerages all offer a total stock market index fund that are functionally identical. They are:

• Vanguard: VTSAX

• Fidelity: FSKAX

• Schwab: SWSTX

Each of those funds will perform identically to each other, so you would never want to pay any fee to purchase one over another. Buy the one with no transaction fee.

NOTE, that this doesn’t apply to ETFs. (I know, it gets kind of convoluted). So if you’re buying the Vanguard Total Stock Market ETF (VTI), that DOES trade free on basically every platform in the US. So you can buy Vanguard’s VTI in a Fidelity, Schwab, E*Trade, TD Ameritrade, Robinhood, or basically any US brokerage with no fee. One easy way to identify mutual funds from ETFs is that mutual funds always end in an X!

Have you ever made this mistake?!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy