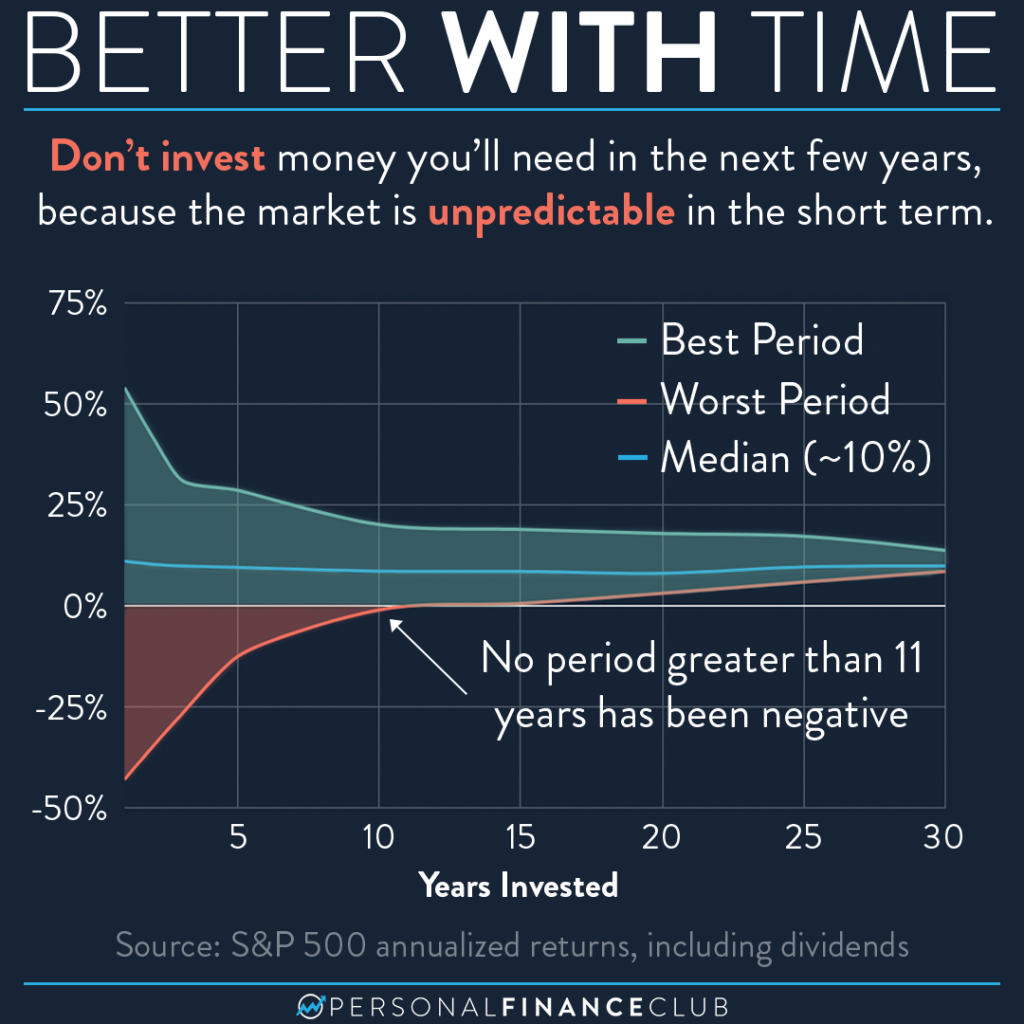

Building wealth by investing in the stock market only really works when you stay invested over a long period of time. Investing within a one year time frame has historically returned anywhere between +50% and -50%! After 15 years, the best average yearly return was +18% per year and the worst was +1% per year. As you invest for longer, the range gets narrower as it approaches the long term median return of 10%.

We often get asked if an emergency fund or a down payment should be invested, and this graph is helpful in answering that question since it’s not a straightforward yes or no. You wouldn’t want your money to be invested and then have the stock market crash right before you need it, so it’s important to assess your risk tolerance. First, think about how many years it might be before you would hypothetically take out the money. Then look at this graph and ask yourself if you would be ok with the risk of the potential downside.

Investing is a long term game. The longer you remain invested, the lower the chance you have of losing money and the higher the chance you have of building a significant amount of wealth.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane

via Instagram