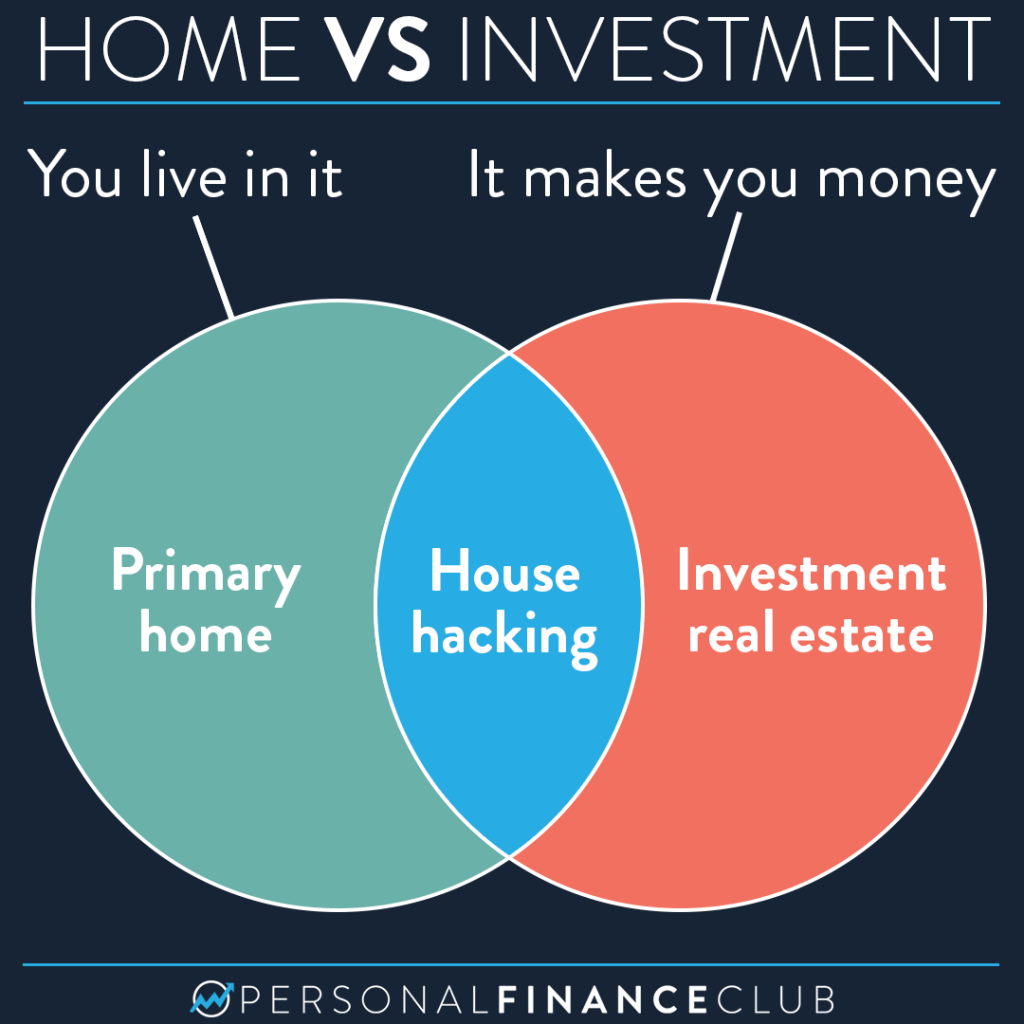

Sometimes I discuss the various costs associated with homeownership to dispel the myth that “your primary home is the best investment you’ll ever make”. And sometimes I may not be clear enough that I’m only talking about your PRIMARY home. If you buy INVESTMENT REAL ESTATE, that’s a whole different ball game. If you live in the home, you’re not making any money from it. If you’re renting it out, someone is paying rent every month. That’s like the difference between starting an illegal drug trafficking cartel where in one scenario you sell the drugs and the other you smoke them all. Selling is going to be more profitable. (This example is a joke. Don’t do nor sell drugs, kids).

Anyway, house hacking is the combination of a primary home and investment real estate. Here are some examples:

• Buying a home and renting out rooms

• Buying a duplex, living in half, and renting out half

• Buying a home, creating an “additional dwelling unit” and renting it or living there and renting the main house

• Buying a run down home, remodeling it while you live there, selling it (for a profit), repeat

• Buying a home and regularly doing vacation rentals for a room or the whole place (when you crash with friends or family)

I have friends who have done every flavor of the above. And in every case those friends are hustlers who have become rich or are well on their way! I love house hacking! If you’re aggressive you can keep your housing costs close to zero from the income, then you’re living for free while you own an appreciating asset! That makes the math on homeownership start to look REALLY good.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram