Well this is how! By calculating the equity you have in each property and putting that number toward your net worth.

For example, if you own a home worth $1 million and you have a mortgage on that home for $1 million, your equity is exactly $0 and that piece of real estate currently adds $0 to your net worth. If you’re “underwater” in your home because you owe more than it’s worth, then owning that home subtracts from your net worth!

In my friend Daniel’s case, he made an incredible real estate purchase back in 2012 and that property value has gone up a LOT and he owes relatively little so he has a ton of equity in that property, which is a big part of how his net worth is over $1M!

If you’ve heard of a “HELOC” that stands for Home Equity Line of Credit. Basically, the bank is willing to lend you money using the equity you have in your home as collateral.

Do you own a home? How much equity do you have in your home?!

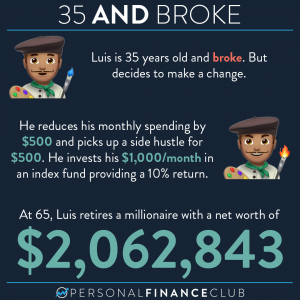

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram