This post is not telling you to stop buying stuff. You need to find the right balance between spending money today on things that make you fulfilled, but also making sure that you are consistently investing as much money as possible. Either extreme isn’t great. If you are miserable today with the hope of being rich in the future, that isn’t a great life. And if you live lavishly today without thinking of the future, you will likely come to regret that.

Prioritize spending money on things that make you happy. Be frugal in areas that don’t excite you. If the act of buying an expensive clothing item is rooted in peer pressure and FOMO, it’s probably not worth buying. But if you get true happiness from an expensive clothing item and know that it will last you many years then by all means you should buy it!

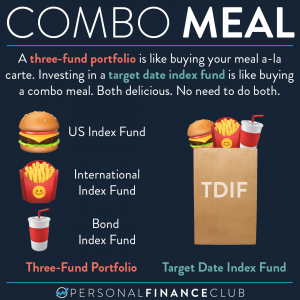

We are taking inflation into consideration in our example. So the “lost savings” is in terms of today’s dollars. We used 7% annual returns in the calculations. Over long periods of time, the stock market has averaged 10% a year. And inflation has averaged 3% over the last 100 years, so the return after inflation is 7%.

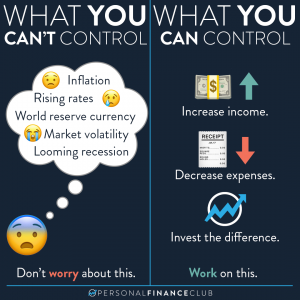

And remember, in any ways that you are able to cut back, you should take those savings and invest them instead in index funds. This is what eventually buys you financial freedom.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane

September Sale!

September Sale!