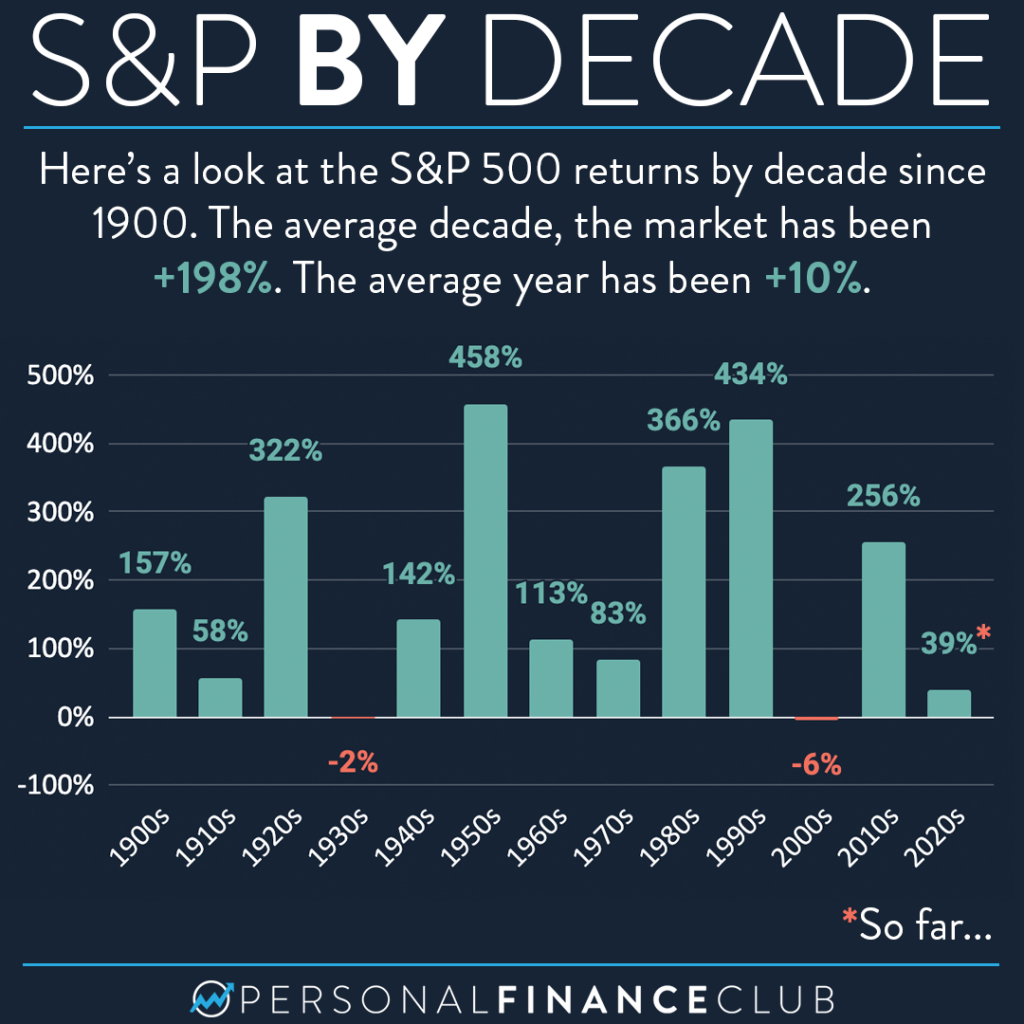

If you invested $1,000 in 1900 in an S&P 500 index fund, today it would be worth over $103,000,000.

Well, that’s not possible for a few reasons. First of all, you weren’t alive in 1900. Second, the concept of index funds wouldn’t be invented for about 75 more years. But that’s not the point. The point is that this demonstrates the awesome power of buy and hold investing and compound growth over the years.

If you had to guess what this chart was gonna look like going forward, do you think expect to see a lot of decades in the red? I don’t. Companies are gonna continue to innovate, grow, and profit. That growth will be reflected in positive returns in the market. And if you put your money in, you benefit in form of compound growth! How exciting!

If you’re new to investing and this is all a little abstract to you, please come check out my free webinar on Thursday! I’m presenting live a crash course on how to get started investing in index funds. Everything from how much money they can make, to what index funds are, to what buttons to click. If you can’t watch live, sign up and we’ll email out the replay. Check my link in bio!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram