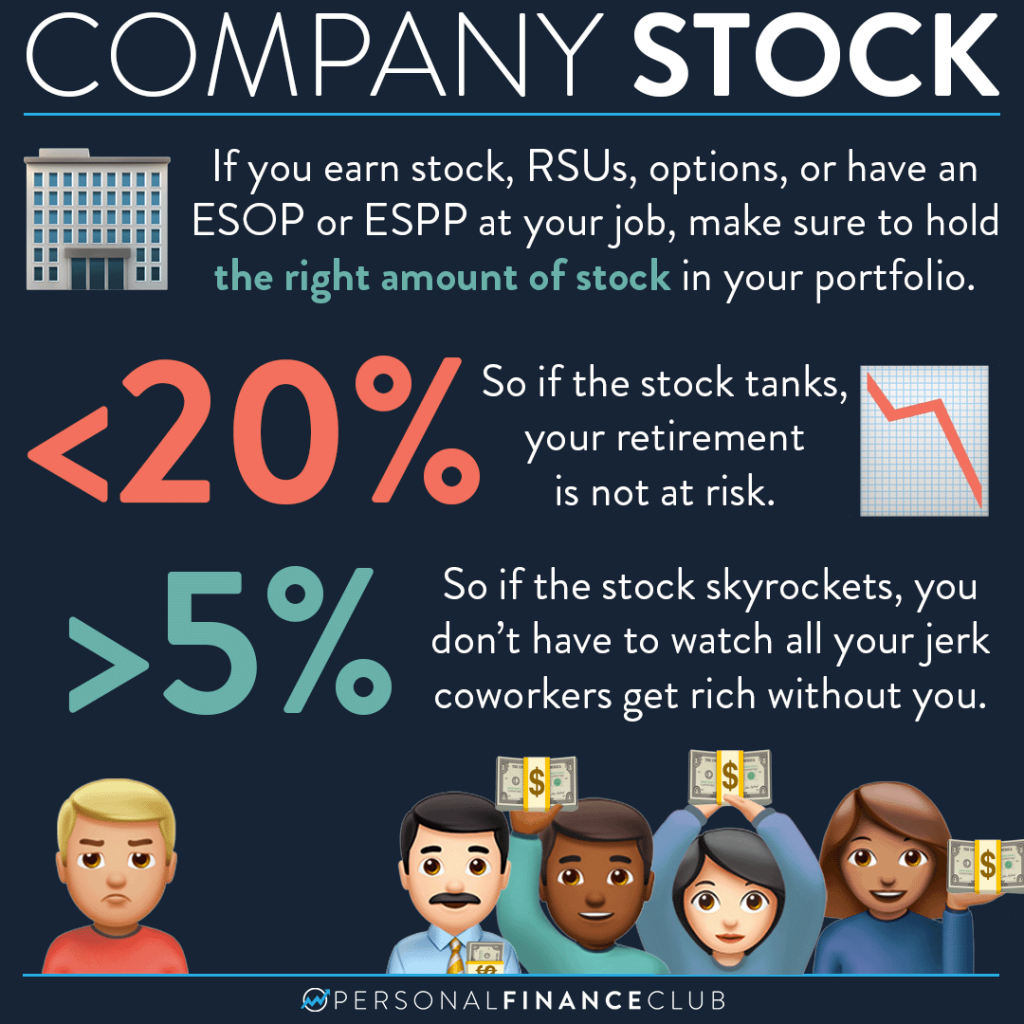

If you work for a company that provides some sort of company stock as part of your compensation, you may find yourself with this issue. Over time, a lot of your investment portfolio may be concentrated on one exact stock. That can potentially be a big problem. If you have $1M in your retirement portfolio, but 80% is in a single stock and that company goes out of business (or the share price drops by 80% which is fairly common for single stocks) you may find yourself suddenly in dire straits for retirement.

The efficient-market Boglehead philosophy would suggest to directly own NONE of your individual company’s stock. That’s because we can’t know which stocks are going to outperform going forward, so why introduce excess risk to your portfolio. And statistically, MOST company’s underperform the market. That’s because just a few greatly outperform. That’s why you buy the haystack, instead of looking for the needle.

But I think there’s an issue that goes beyond the theory here. That is, sometimes you DO work for a company that dramatically outperforms the market. Owning a significant portion of that stock can act as a lotto ticket. And you don’t want all those jerk coworkers to win the lotto without you! There may also a psychological benefit to be motivated to help grow the one stock you have some control over.

But don’t get carried away! If you see your company stock start creeping above 20% of your total portfolio, it’s probably time to sell and convert some of that stock to index funds. In practice, that may look like waiting until you have an open trading window (whether it’s avoiding blackout periods, waiting for stock to vest, or waiting for a short term gain year to end) selling the stock and buying an index fund. That gives you the benefit of the stock award and gain, plus the security of the growth of an index fund going forward.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy