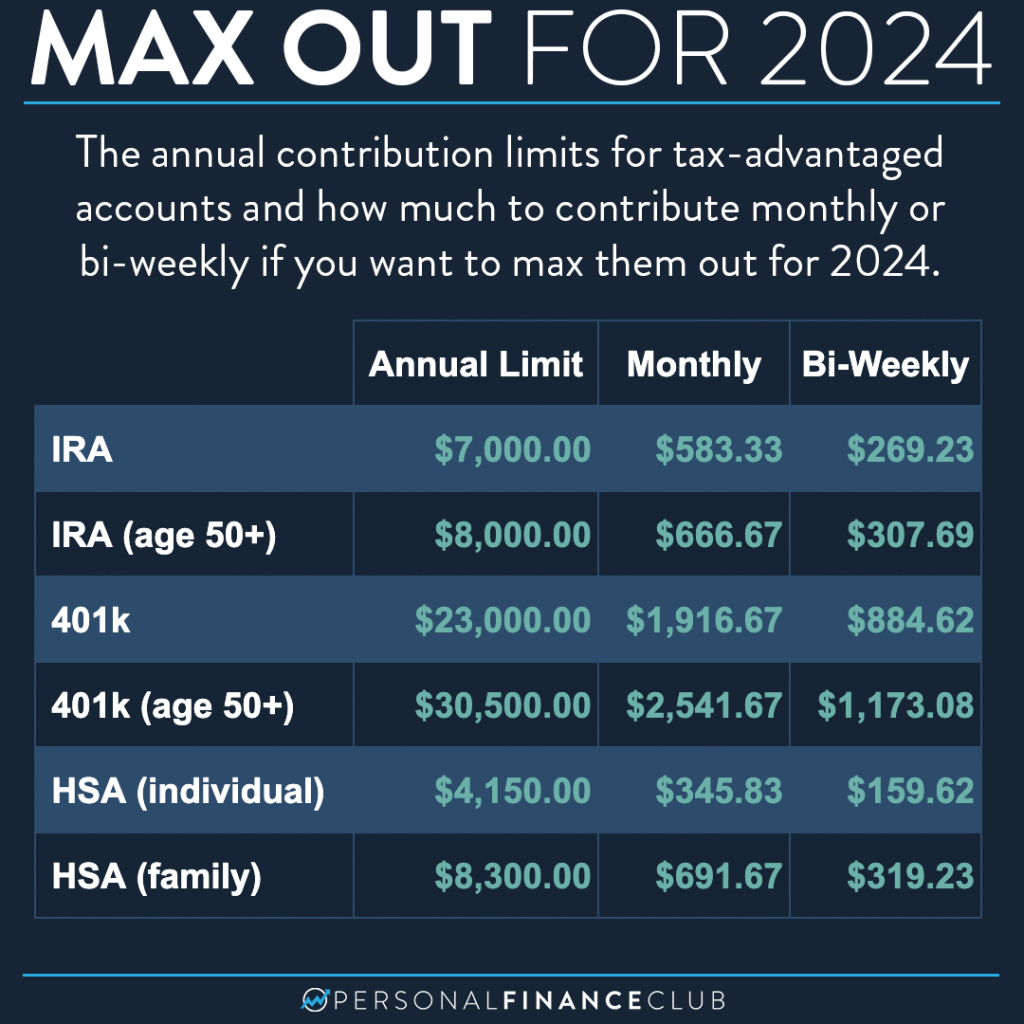

One of the first things I do in January every year is max out, or make a plan to max out, every single tax-advantaged account I have access to. The more money I can cram into these accounts, they more money I have protected from taxes and the more my wealth will grow over time!

This year I maxed out a (backdoor) Roth IRA. I dumped in all $7,000 at once. I also maxed out my individual HSA contribution of $4,150 in a lump sum. For my 401(k) which is done via payroll deduction I decided to spread it out evenly over the year. We do payroll bi-weekly at PFC, so that comes out to $884.62 per paycheck. Unfortunately my payroll system requires full dollar amounts (no cents), so I rounded down to $884. I like doing the dollar amount instead of a percent of my pay so I know it will fill up exactly and evenly over the course of the year.

Sometimes people ask me things like “But $884 times 26 paychecks only equals $22,984, what do you do about the missing $16?”. The overarching answer is it doesn’t matter. It’s 16 bucks. You spent more at starbies this morning. But if you’re OCD, most 401(k) plans and payroll systems will automatically cut you off when you hit the contribution limit. So you could just change it to $885 which would max out your full $23,000 and the last contribution would just be a little bit less.

For me, in total, I’m able to contribute $34,150 into these tax advantaged accounts this year! The 401(k) and IRA are both Roth which means that money will never be taxed again. And the HSA also spends tax-free on qualified medical expenses. Assuming I use that benefit, that means ALL of this money will never see another penny of tax even after all of its growth. If I let it cook for 25 years and get a modest 7% return, that will be over $185,000 I can spend in retirement!

Some people critique “Do you really want to wait until then to be happy?” NO. I want to be happy BOTH TIMES. That’s why I’m enjoying my life now AND setting myself up for success later!

Thanks to @mrchook_ for the idea!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

September Sale!

September Sale!