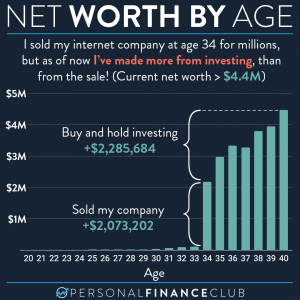

When you procrastinate in college, you’ll still graduate with the same degree. But in the case of investing, procrastination could cost you a MILLION dollars. By letting ten years slip by before investing, Nate’s portfolio ended up just a fraction the size of what Nora’s money grew to.

What’s the main takeaway? Start today. If you don’t have the money, just invest a small amount. Getting started is the hardest part and there’s always going to be an excuse not to. But, starting now vs later can make all the difference in the world.

This post isn’t meant to make you feel guilty if you didn’t start investing early. The past is not in your control. Focus on what you can do today to set your future self up for success.

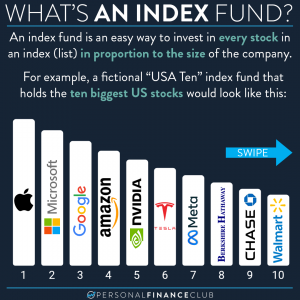

In our example, we are assuming Nate and Nora invest in an index fund that tracks the S&P 500, which has averaged 10% returns per year over the last 100 years, including dividends.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Vivi & Shane