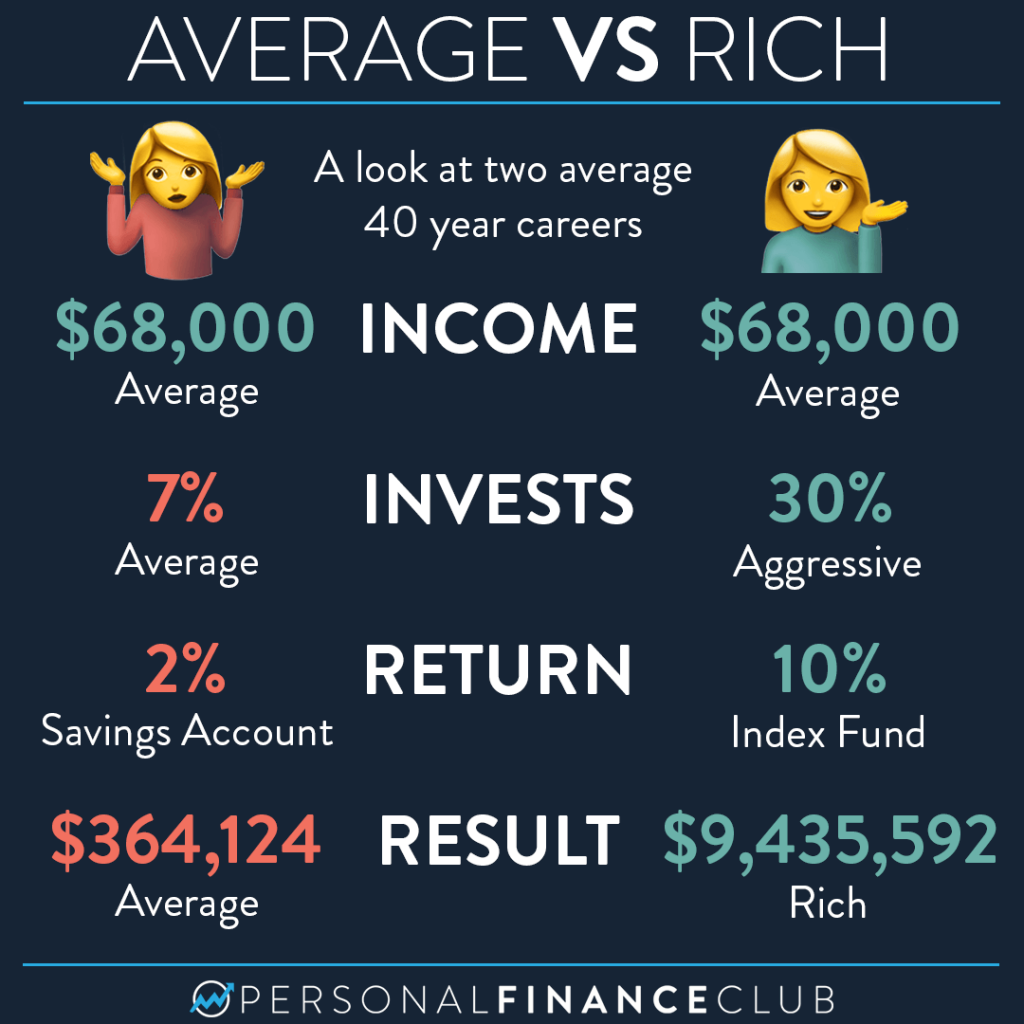

Becoming wealthy isn’t a very complicated equation. Spend less than you make. Invest the difference in low cost index funds. Leave it alone for a long time and let compound growth do the work.

Yet most of us end up like shruggy girl emoji on the left. Save just a little. Don’t bother to figure out how investing works (It’s not like it’s gonna cost you $9 million dollars!) Then wake up when you’re 65 and start to rifle through your old mail looking for that social security paperwork when you realize you don’t want to work until the day you die.

But tippy girl emoji on the right didn’t do things THAT much differently. In fact she has the exact same salary. But instead of saving 7%, she invests 30%. That means she’s living on $47,600 per year instead of $63,240. Is it THAT much different? No, probably not. Slightly cheaper car and housing and you’re there. But the end result is MASSIVELY different. About to crack 8 figures in investments vs scrambling for social security. Or maybe she retires 10 or 15 years sooner with a few less million. That wouldn’t be so bad.

And these are broad strokes numbers, ignoring some of the details. It’s assuming 10%. (The previous 40 years of the US stock market actually returned 11.5%). It ignores taxes (although all this money would easily fit into a Roth 401k and Roth IRA making the $9.4M 100% tax free). It ignores inflation (But $9.4M is still a lot of cheddar even with inflation, plus tippy girl might increase her contributions as her salary increases making up the difference).

But don’t let the details distract you from the message. Spend less than you make. Invest the difference in low cost index funds. Leave it alone for a long time and let compound growth do the work. The more of that you do, the more rich you’ll become!

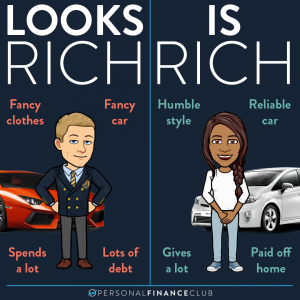

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram