Over the weekend I reflected on how nice it was that my money was working even though I wasn’t! As of today my net worth is about $4.5 million. Of that, only about $16,000 is in cash. That’s 0.3%. The other 99.7% is at work!

What are those working dollars doing? Most of them are sitting in index funds. From my perspective, they look pretty darn similar to the money sitting in cash. Both are in my Fidelity account. Both reflect in the balance. Some of those working dollars committed to long term gigs inside an IRA. Most are in a regular brokerage account where I can still access them any time (although I try not to disturb my working dollars while they’re at work).

But despite looking similar, the difference is huge. The invested dollars are hard at work recruiting more of their friends back to my account! When I quit my job in 2017 my net worth was about $3M. Since then it has gone up $1.5 MILLION DOLLARS. Not because I’ve had a high paying job. I haven’t had any job! It’s just all those little working dollars bringing in the big bucks.

And certainly it would be nice if we all started with $3M. (I didn’t… it took me about 16 years to get there, including grinding to grow and sell a company). But starting with any amount, invested monthly is the beginning of the massive snowball effect of compound growth. So get started!

I think it’s important to have SOME money in cash. Maybe 3-6 months of your living expenses in cash between your checking account and emergency fund. But anything over that should be put to WORK. First pay paying off non-mortgage debt. And if you’re debt free, then get those dollars invested!

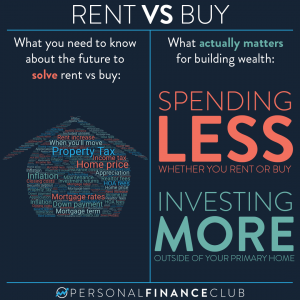

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram