Fear of the unknown can be so intimidating. And getting started investing is walking into a world that is SO unknown to most people and SO intimidating. And I’m certainly guilty of encouraging an “all in” approach. INVEST HALF YOUR PAYCHECK! DUMP THAT LUMP SUM IN THE MARKET! I say that kind of stuff because I believe it’s mathematically optimal, but if it’s scary to you and keeping you from getting started, then screw that! Don’t let perfect be the enemy of good! Start with $100.

You can blow $100 on a shirt or a dinner or tank of gas or just about anything these days. So take that $100 and use it as what might be the most valuable education of your life. Go open up a brokerage account. Forget about Roth IRAs (for now). With a regular brokerage account, you can take OUT your investment whenever you want. Total retreat plan!

The cool thing about investing in an index fund is investing $100 works the same way as investing $1,000,000 (I’ve done both!) The only difference is is the latter requires pressing the zero key an additional four times. But that means once you’re comfortable with the process, you can ramp up the investments (and thus returns) as time goes on!

This is also a good tip if you have a high fee advisor and you’re considering a DIY approach. No need to pull the ripcord and immediately dump your advisor. Why not start a separate account and try it on your own for a while. Compare what you’re doing to what the advisor is doing. If you understand both, feel comfortable with the process, and understand the impact of fees, then go ahead and make the move. But no need to jump into a the pool before testing the temp with a toe!

If you need a little more guidance on what buttons to press to get started, I have a “start here” video series on my website. It’s free, no email required. Just 10 videos of about 5 minutes each that walk through the best practices!

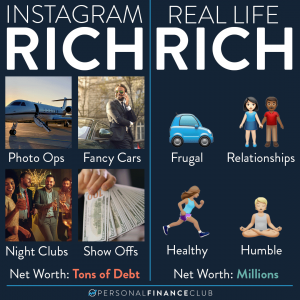

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy