I don’t expect this post to do well. It’s not sexy. But it might make you more money than of my other posts.

Meanwhile, my “Tesla car vs Tesla stock” post is one of my most popular of all time. People LOVE to revel in the missed success of the recent past. If only you saw Tesla’s insane run up happening. If only you knew what bitcoin would do. If only you bought Apple when it was on the brink of bankruptcy…

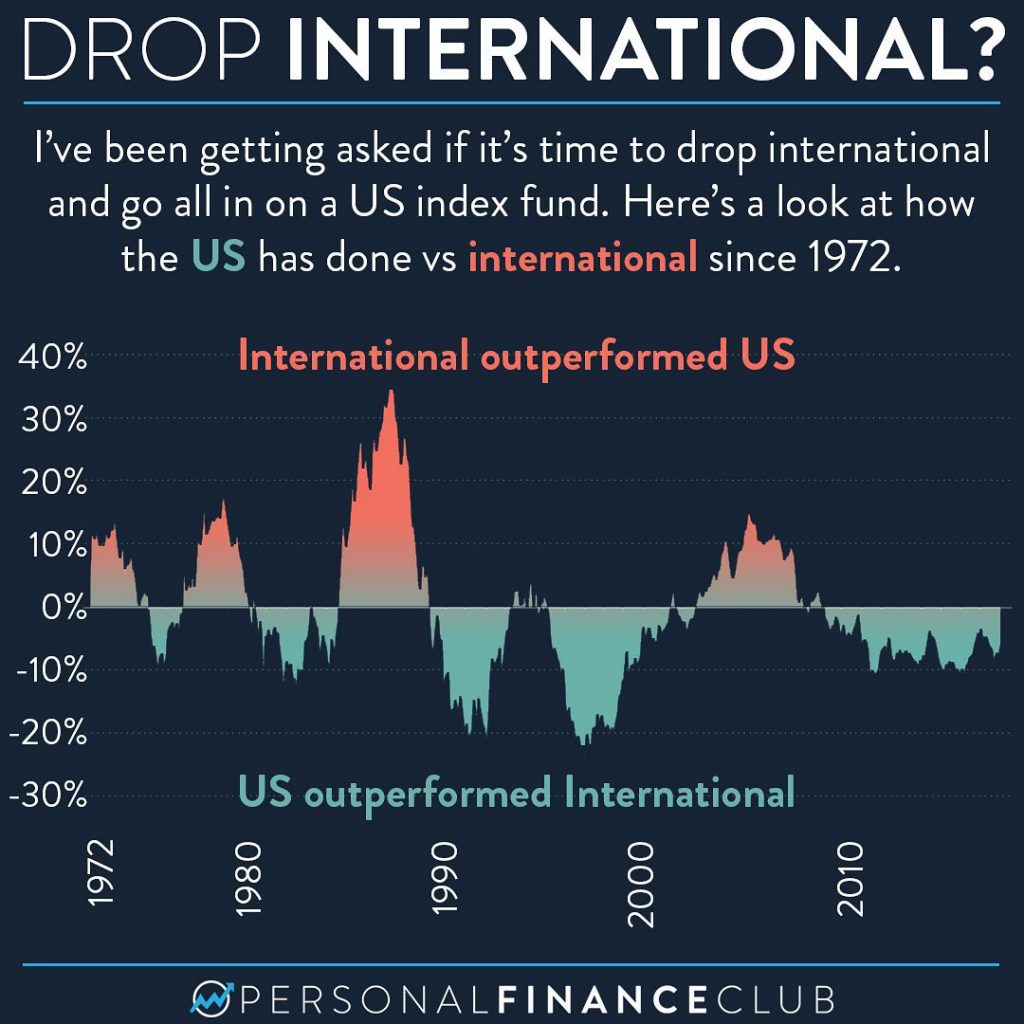

But wealth isn’t made looking backwards, it’s made looking forwards. And as we stand today, the US stock market has outperformed the international market over the last decade or so. So I’m always getting the question “Should I drop international?” Why would you bother holding an underperforming asset class?! Well, if I could go back 10 years ago, of course I wouldn’t buy it. I’d buy bitcoin, Tesla, and Zoom. But imagine the next 10 years. Do you think it’s going to be exactly the same as the last 10? I bet not.

And when you look back at the last FIFTY years, the US and international markets have swung back and forth like a pendulum. The moment you drop international due to underperformance will probably be right around the time it starts outperforming.

So stop trying to relive the success of the last decade based on what we know now. Instead, use best investment practices going forward. Keep your international allocation to guarantee your fair share of world economic growth going forward. You don’t want to be that guy who keeps changing lanes in traffic on the freeway only to see your old lane start zooming ahead.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram