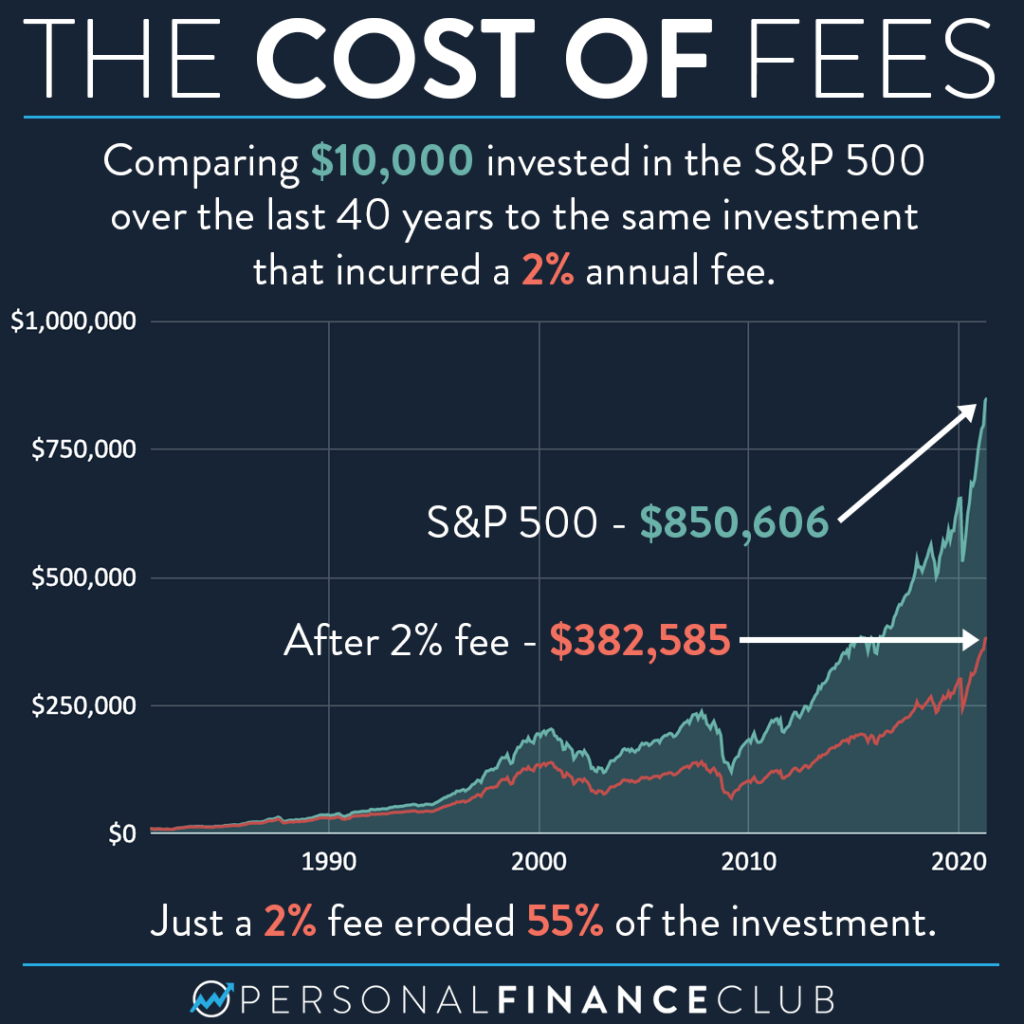

If there was a way to pay someone to produce better than average market returns I would be ALL OVER THAT. Pay 2% per year and beat the market by 5%?! ABSOLUTELY that would be a great deal. And there is also no shortage of investment advisors, mutual fund managers, hedge fund managers, and day traders who claim to be able to do this.

Unfortunately, due to the unrelenting rule of averages, not everyone can be above average. Of all those active investors who charge a 2% fee to beat the market, on average all of them will equal the market (because they’re competing against each other). Net of fees, on average they’ll lose to the market by the cost of their fees.

So why not just pick the GOOD active managers who DO beat the market? Well, because it’s impossible to know who those will be in the future. We can certainly look at who beat the market in the past, but by the time you know it’s too late. Study after study show that those who beat the market in the past are no more likely than any others to beat the market in the future. So if you pay them to try, you’re just gonna get average expected returns and lose out on the fee on top of that.

I harp on fees so much because it’s the only thing that can actually predict future performance of a fund. The lower the fees, the better the expected performance.

And these fees can be tricky to spot. Any mutual fund or ETF you buy has an “expense ratio”. I consider any expense ratio under 0.2% to be very low and anything over 1% to be very expensive. Some funds also have “loads” which is a transaction fee. Some trades incur transaction fees. Some financial advisors charge sweep fees, annual fees, statement fees, etc. The best way to identify your fees is to check all your expense ratios, then look closely at your statements for any other fees being taken out of the money you put in!

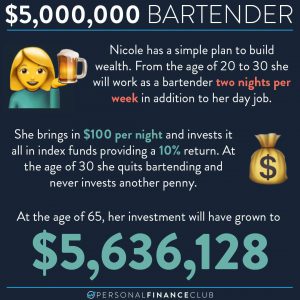

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram