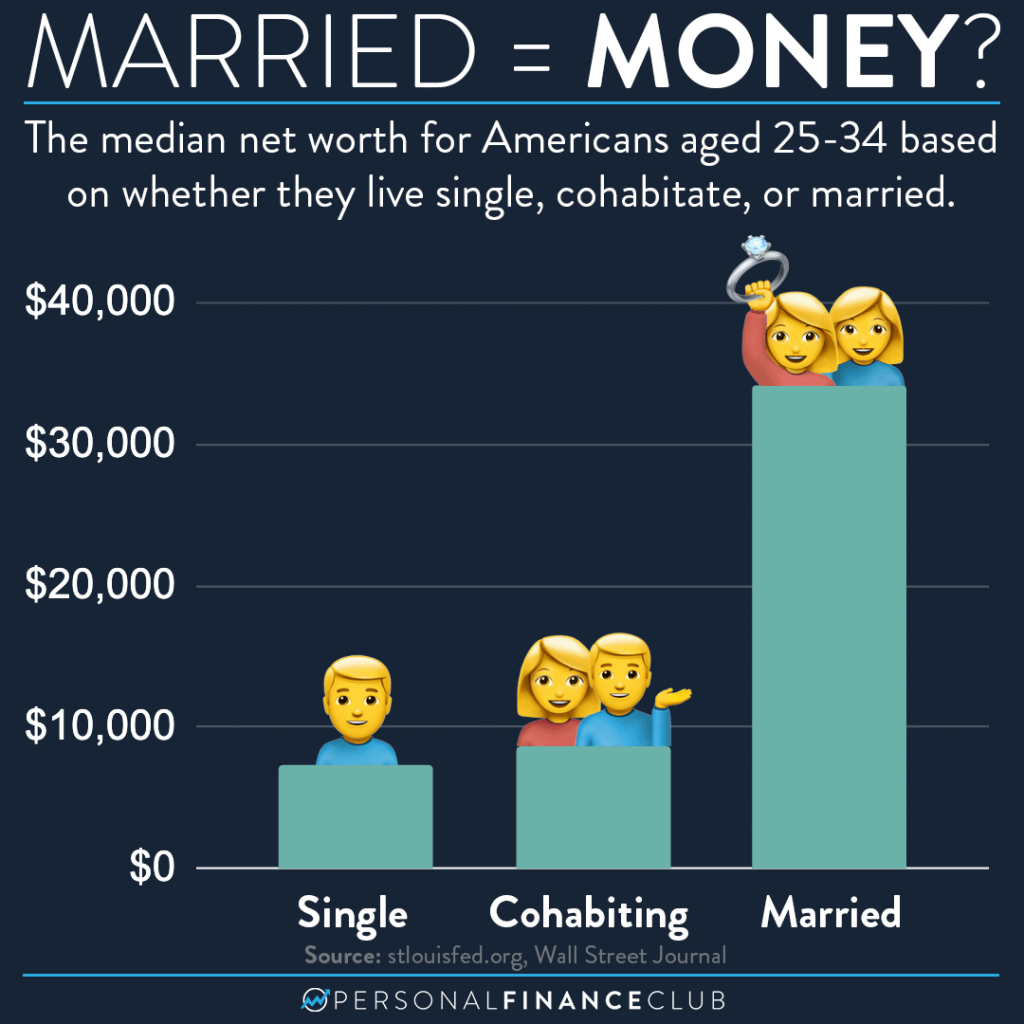

Living with a roommate or partner has undeniable financial advantages. Splitting rent or mortgage, utilities, food staples, and possibly even transportation, and more. Yet this data shows that married couples enjoy FOUR TIMES the net worth of unmarried couples living together.

A Wall Street Journal article covering this statistic speculates it’s largely due to the long term mindset of marriage vs dating. They say married couples are more likely to save and invest together for long term goals. I think that’s likely PART of it, but there may be a hidden variable here lurking below the data. I suspect that in this case, correlation largely does not equal causation. That hidden variable? Weddings are EXPENSIVE. According to The Knot, the average cost of a wedding in the US is about $30,000. If you’re a couple who has a combined net worth of under $20,000 you’re probably less likely to spend $30,000 on wedding. Meanwhile, if you have a combined net worth of $100K, spending $30K on a wedding will still leave you with about the median net worth shown here. Even if a family is paying or helping pay for a wedding, a family with money likely correlates very closely to a young couple with money.

I’ve heard another similarly misleading stat. “The median net worth of US homeowners is 40x higher than that of renters”. Maybe. But guess what. Houses are really expensive! BUYING a house doesn’t make you rich. But being rich makes you more likely to buy a house. I could quote another stat like this. “The median net worth of US private jet owners is 40,000x higher than that of non-jet owners”. Does that mean buying a jet makes you rich? No. Does buying a house make you rich? Usually not. Does getting married make you rich? Probably not. Do all these things with caution while focusing on your goals!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy