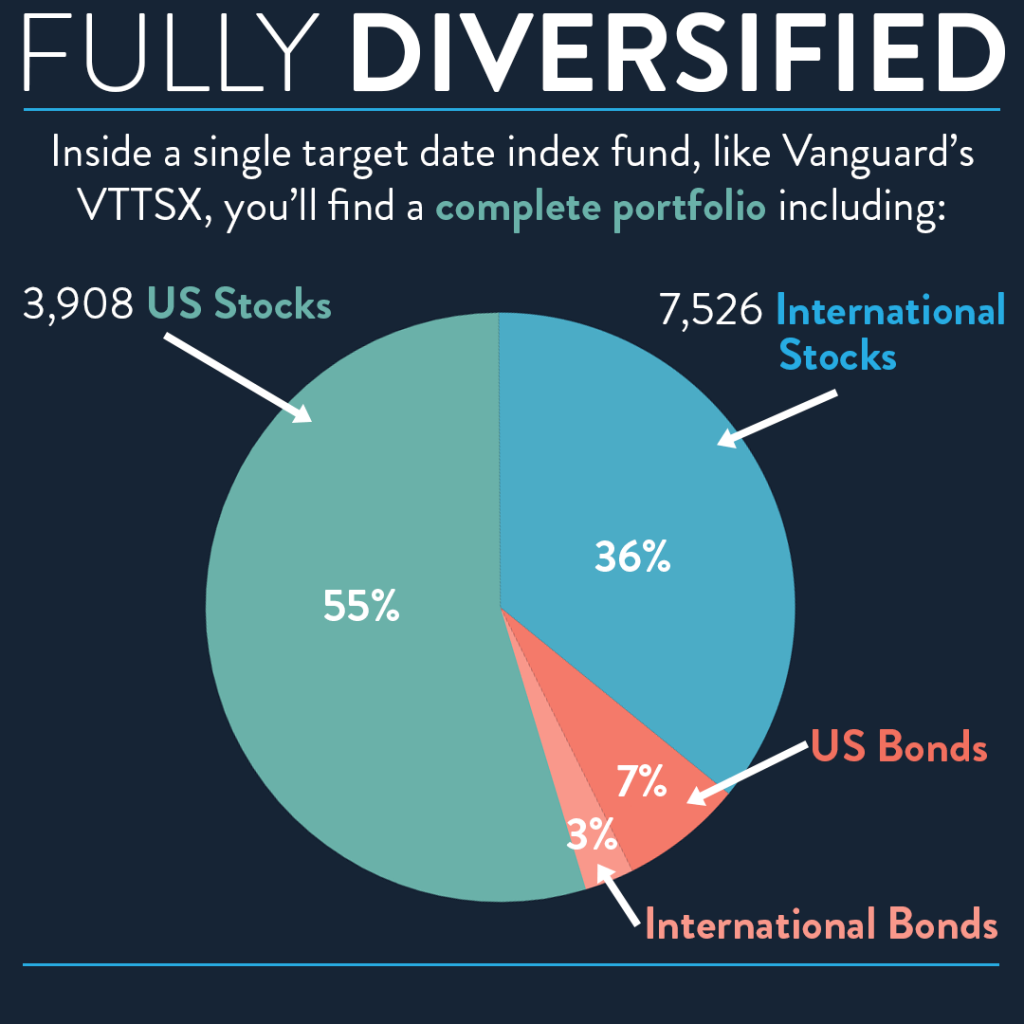

When I put money in the market, it’s into a target date index fund. Want to know if I own Tesla? Yep, it’s in my target date index fund. Apple? Yep. Samsung? Yep. Ford? Yep. THEY’RE ALL IN THERE.

The stock market is very “efficient”. That means every stock is priced based on the sum total of human knowledge. THAT means it’s a fool’s errand to try guess which stocks are going to outperform all the other stocks going forward. Doing so simply introduces additional risk and volatility without a higher expected return. In investing, that’s a bad tradeoff.

So what do you do? Diversify! Buy buying ALL the stocks, you guarantee yourself your fair share of all market growth. Apple has a hugely profitable quarter? Great, you own that! Some biotech firm you’ve never heard of invents the next vaccine? Great you own that too! All the growth and dividends from the world’s stocks and bonds are routed directly back to you in this low cost, convenient package.

But wait, there’s more. A target date index fund also “reallocates” as you age. VTTSX pictured here is Vanguard’s 2060 target date index fund. That means it’s designed for people born around 1995 (who will hit traditional retirement age around 2060). When you’re young, you want your portfolio to be very aggressive (almost entirely stocks). But most people in their 60s and 70s end up wanting a more conservative portfolio. The idea of working your whole career to accumulate millions just to see it cut in half when the stock market has a hiccup isn’t so appealing at that age.

But if you’re manually trying to move from stocks to bonds as you age, that can be a complicated process that is prone to human error or emotion. So target date index funds do that for you. That takes the guesswork and emotion out of the process!

So if you plow every investing penny of your life into a single target date index fund, I would call that optimal investing. Anything that drifts from that strategy gets into the realm of speculating or gambling more than solid investing best practices.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram