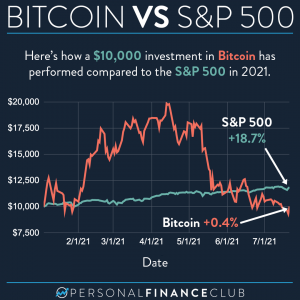

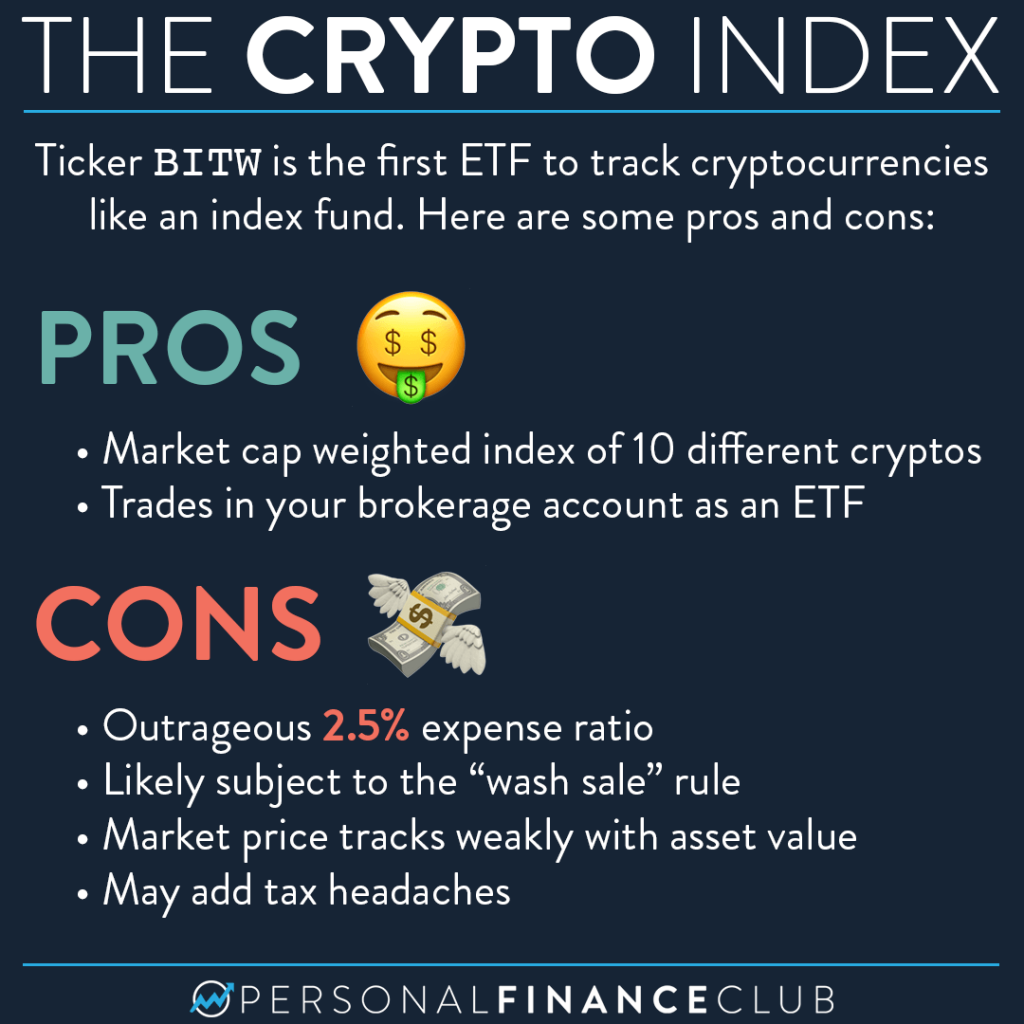

I’m not the biggest fan of crypto (I prefer assets that appreciate in value and provide income like stocks and investment real estate) but the idea of a crypto index fund is appealing. One of the challenges with buying crypto is trying to figure out how much of which crypto you buy. Which crypto may become the next Bitcoin is anyone’s guess. And since it’s a very liquid market, it’s safe to assume the world’s knowledge of which crypto is the next big one is already priced into those values. So simply buying all the cryptos, in proportion to their market caps is a nice solution for the same reason it’s great for buying stocks. Being able to do that in a brokerage account, instead of a crypto wallet, is additionally attractive to me simply for the convenience.

That said, this crypto ETF has some pretty big drawbacks. First, the eye-watering 2.5% annual expense ratio. If you think crypto is a hedge against inflation, losing 2.5% of the value annually to fees is a sure way to erode that benefit.

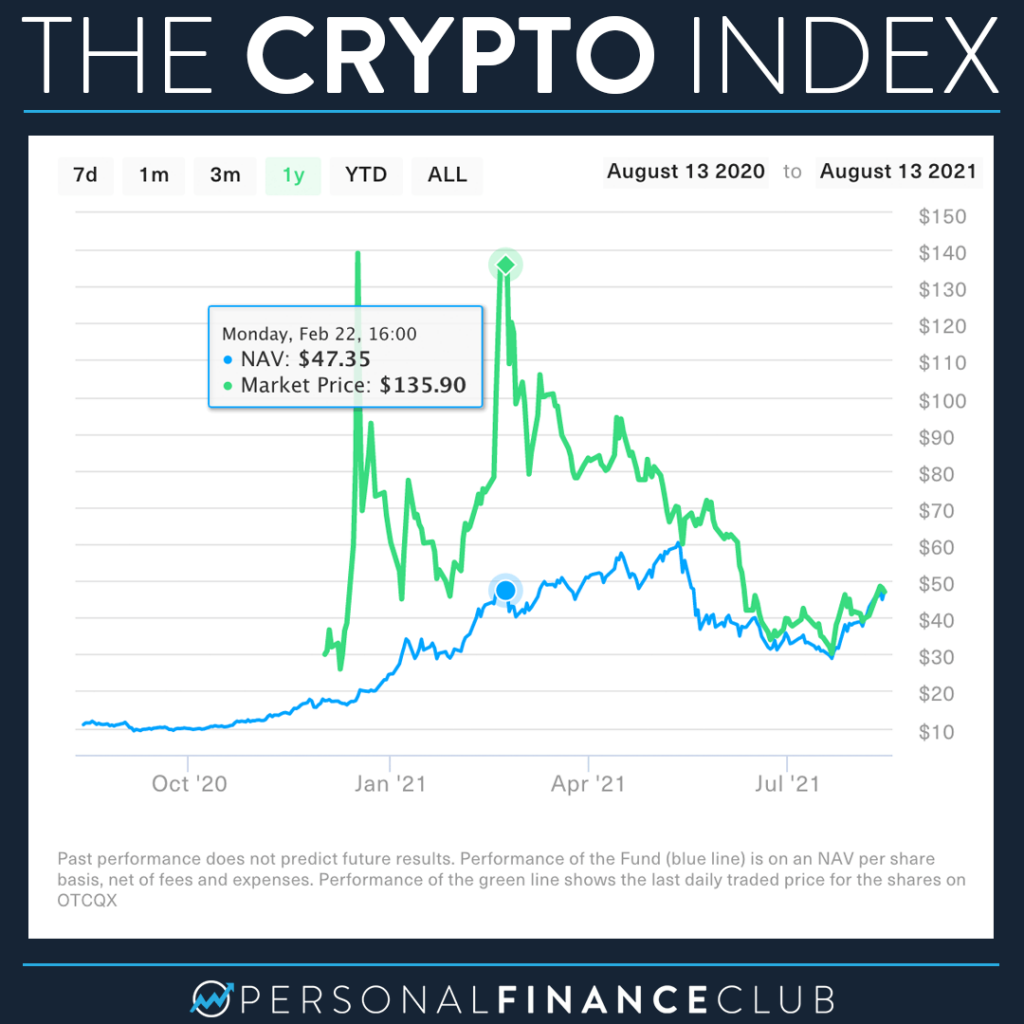

Next is that what you pay for the ETF isn’t necessarily what you’ll own. The chart on the second image shows the market price of trading the BITW ETF vs the “net asset value” of the underlying assets. In February you would have paid $135 to get $47 worth of crypto! Ouch! It looks like those lines are converging, but who knows if they’ll stay close in the future.

One benefit of directly owning crypto is that it’s not currently subject to the “wash sale” rule. That means if you have a crypto loss, you can sell that crypto, then immediately buy it back and claim the loss on your taxes. This assumes of course you’re carefully reporting your crypto gains and losses on your taxes! With the BITW ETF you get a K-1 each year which may make filing taxes more of a hassle and eliminate the opportunity for a wash sale.

The cons are definitely enough to keep me away!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

p.s This post was inspired by a question on the PFC community forum! Join us to browse, ask, or answer questions over at community.personalfinanceclub.com 🙂

via Instagram