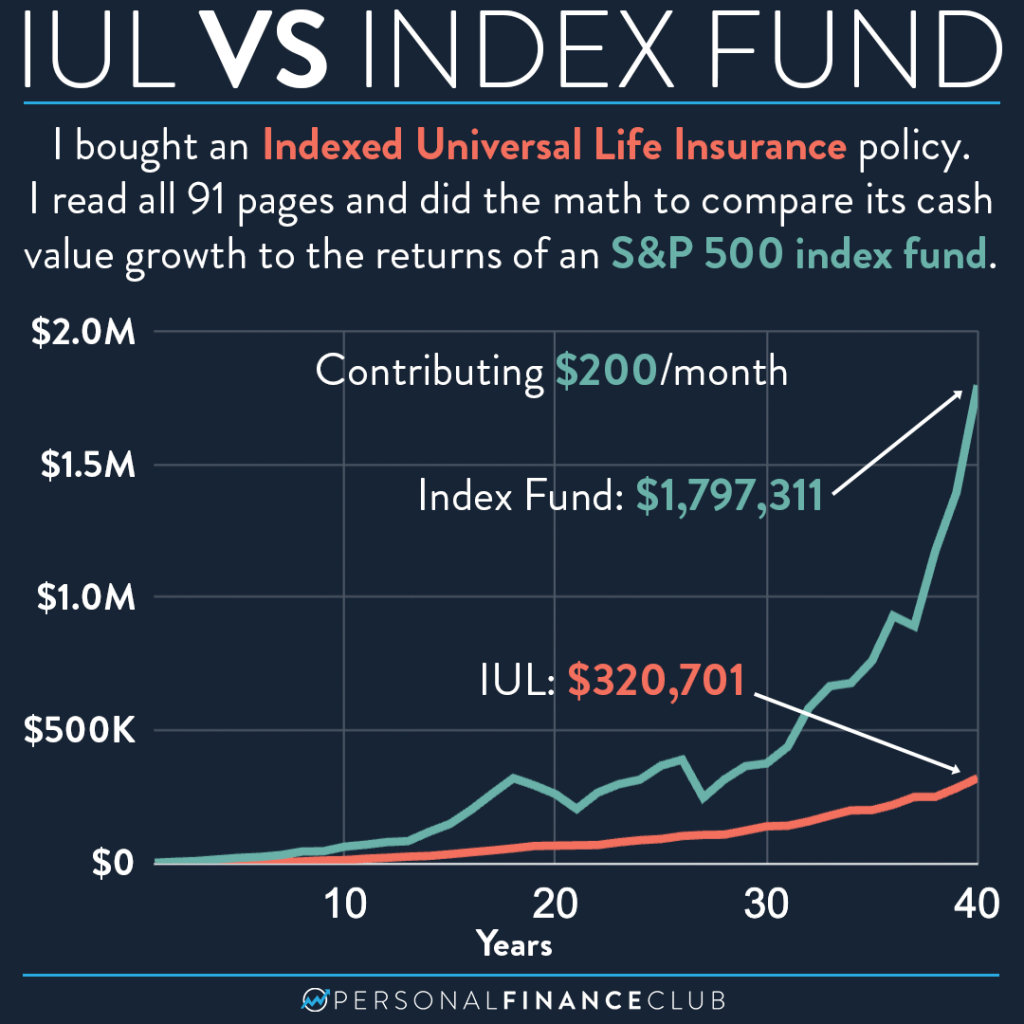

I did a similar post a few years ago comparing the growth of an IUL to an index fund. My analysis came to the conclusion than an IUL would end up at about 37% of the value of an index fund. But that analysis was difficult because I didn’t actually own an IUL policy. I had to go based on the publicly available marketing information which notoriously doesn’t mention the huge associated fees.

So, one day while scrolling TikTok I saw an insurances salesman espousing the amazing financial returns of these IULs, so I clicked on his link in bio, sat through a 90 minute sales pitch, and bought a policy! When it arrived, I did a careful accounting of all the fees, put together a model in a spreadsheet, and after including the fees the IUL actually ends up with 18% of the value of an index fund!

I have a longer article breaking down every lie told by the insurance salesmen (ignoring dividends, ignoring fees, cost of insurance, tax benefits, infinite banking, etc).

I first posted that article last year, and understandably insurance salesmen don’t like it and have attacked the article and me. But in the article, I link directly to the spreadsheet I used to do the calculations, open for any and all scrutiny.

One such IUL fan did in fact attack me over an error. He correctly noticed that I had made a typo in the fees I was charging to the index fund. The fees are so small, I made a typo and listed them at 0.003 (0.3%) when they’re actually 0.0003 (0.03%). Of course, I corrected it which made the analysis even WORSE for IULs, but it didn’t stop the IUL salesman from lying and attacking me over it.

If YOU are being sold an IUL or any other type of permanent life insurance, be extremely skeptical of the claims made by the salesperson. In my experience, they’re generally all lies and the opposite of what they’re claiming. If you already have one, it may be time to look at the performance and consider stopping putting more money towards it.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy