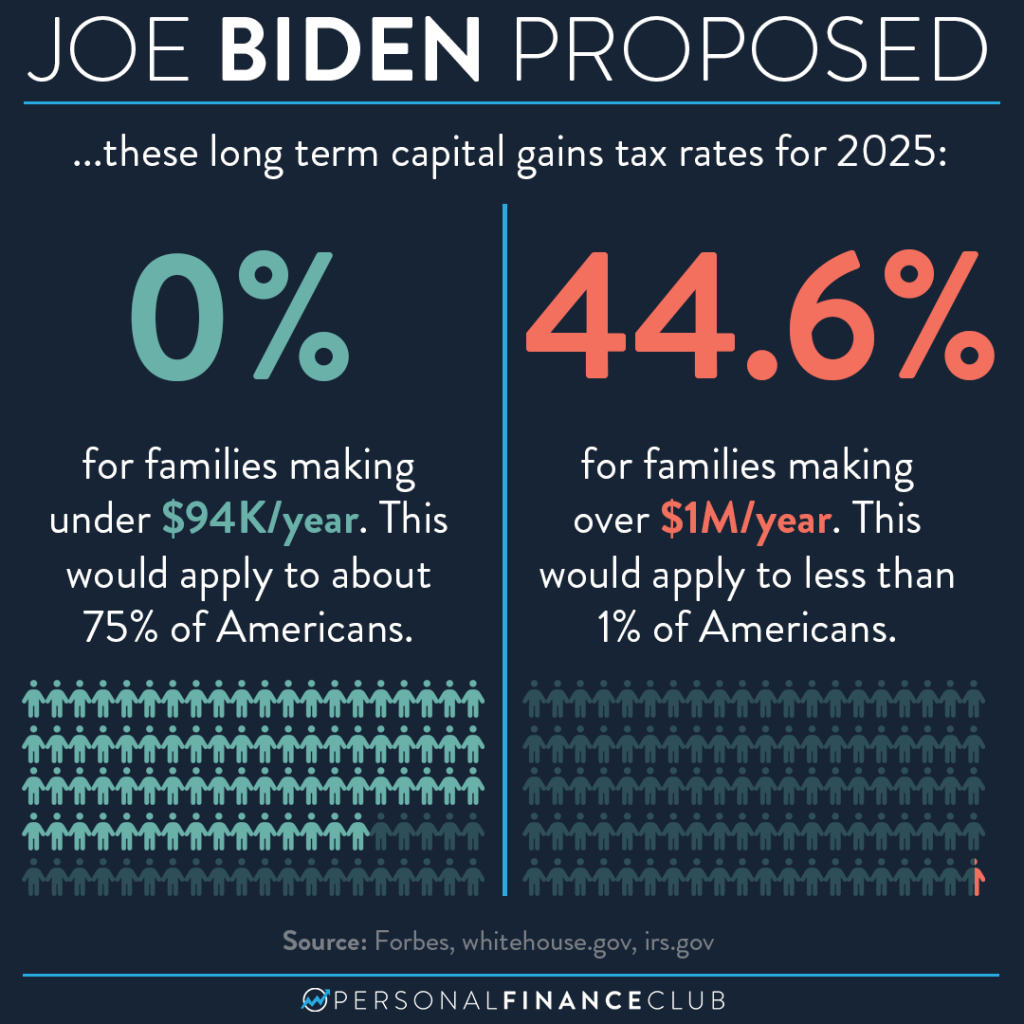

There’s been some outlandish headlines floating around the last few days about how Joe Biden is going to tax everyone 44.6%. This outrage clickbait is 99% nonsense, 1% substance as usual. Let’s breakdown why:

• This isn’t the tax rate for income, it’s the tax rate for long term capital gains. That means money making money (in a taxable account, not your IRA or 401k).

• This is a proposal. That’s a starting point for negotiation. It’s very hard to raise taxes in the US so it’s likely this won’t happen at all, but rather be used as a bargaining chip in negotiation.

• It would apply to very few people. As this post shows, MOST Americans will still be subject to a 0% long term capital gains tax rate. The proposal says that only those with adjusted gross income over $1 million AND investment income of over $400K would be subject to this top marginal tax rate.

Like most of us, I’m against higher taxes. But I’m also FOR a balanced budget. A balanced budget means we can’t spend more than we make. There’s two sides to that coin: Spending less and making more. I’m against raising taxes and we should always be looking for ways to cut spending. But if we do need to increase income, those making OVER A MILLION DOLLARS PER YEAR are doing pretty darn well, and I’d rather them pay in a bit more than try to shake down those making the median income or less.

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy