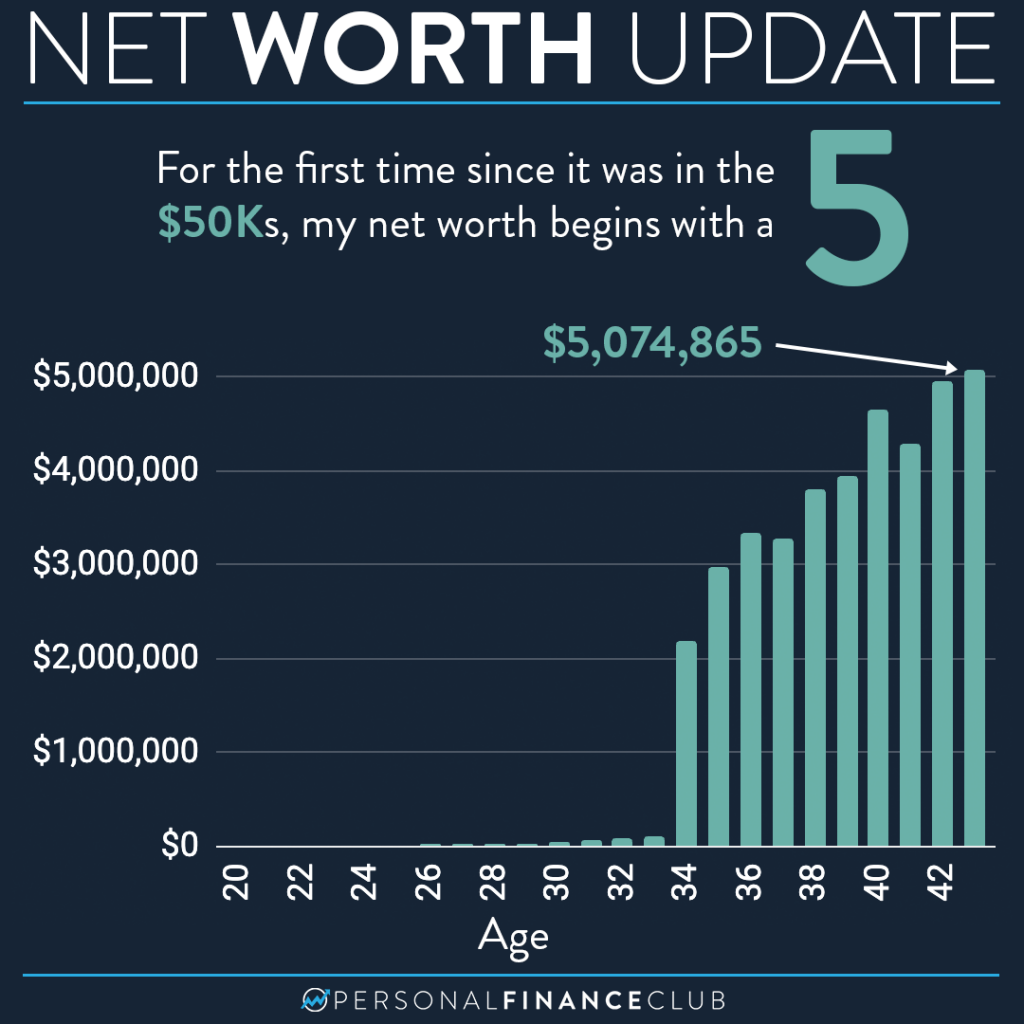

This is kind of an exciting milestone for me. When I was 34, my max take home salary up until that point was $36k/year. I was living on less than that and investing and had grown my net worth to over $100,000. Then I sold the internet company I started at 22 for just over $5M. My share after taxes was about $2M. Going from making $36K/year to having $2M in the bank was wild. But even then I wasn’t really sure I was “set”. The line in the sand I had always drawn for myself was $5M. I figured if I could get there, I would be “fat fire” from then on.

“FIRE” is financial independence, retire early. “Fat FIRE” is when you’re not only financially independent, but you can actually indulge in some luxuries too. The idea of FIRE is loosely based around the 4% rule. That rule says that whatever your starting amount of investments are, you can take 4% per year from that, adjusting it upwards for inflation every year and be very unlikely to ever go broke based on the historical stock, bonds, and inflation numbers.

My net worth isn’t all liquid in investments. Notably about a quarter of it is in my primary home. But IF I were to liquidate everything, and take 4% of my $5M, that would be $200,000/year. That’s $16,667/month. That’s WILD to me. Last year I spent about $5,000 per month, which felt luxurious to me. As I’m typing this, I’m literally scratching my chin in bewilderment.

Another interesting note is clearly a large portion of my wealth came from selling a company. But at this point, MORE of my wealth has come from investing!

If in April of 2015 when I sold my company I dumped every penny of it into the S&P 500, today I would have about $5.3M. That’s not QUITE what I did. I invest more diversely (including international and bond index funds), plus I bought my home, and still am working on building some companies. But BROAD STROKES, I went from $2M to $5M from buying and holding index funds!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy