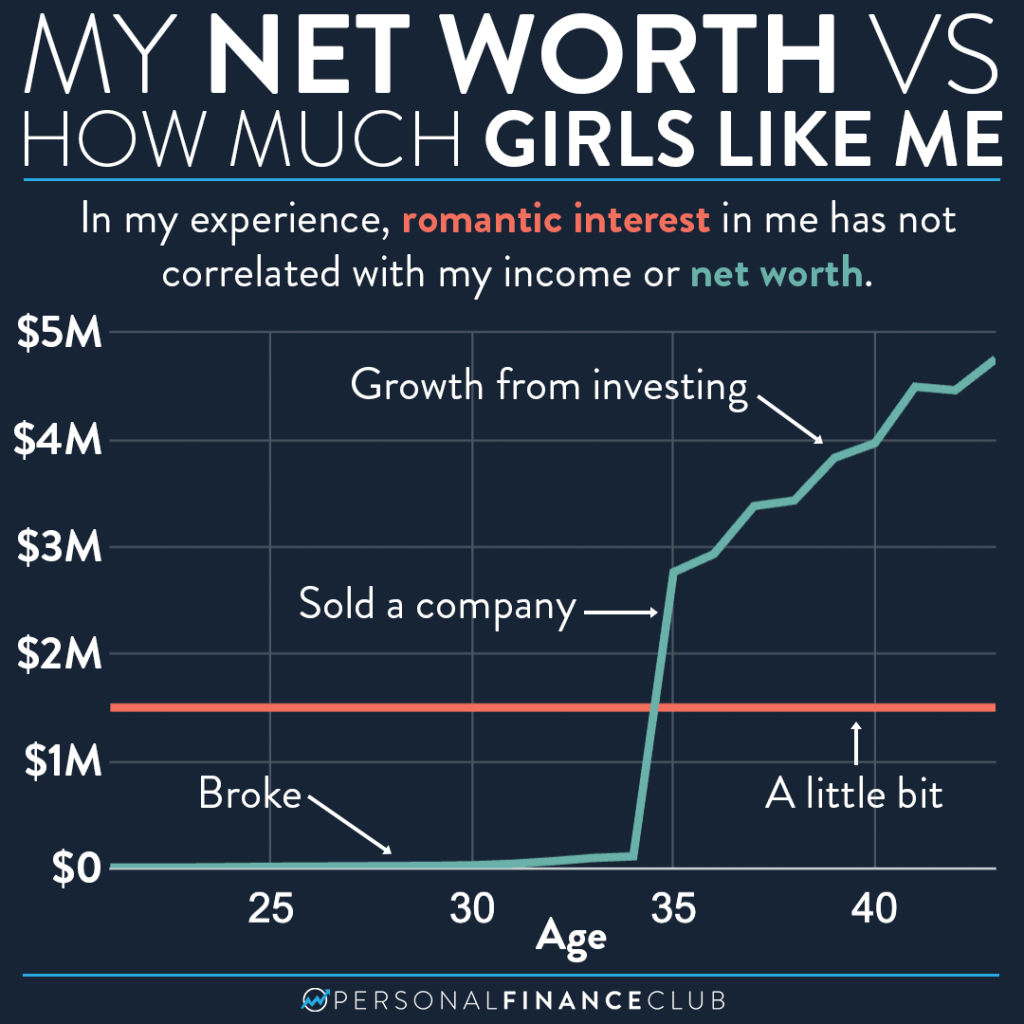

I think there’s a few reasons for this lack of correlation. First, I think the (somewhat misogynistic) idea of a “gold digger” is largely a fictionalized creation of media or pop culture. In my personal experience I’ve rarely if at all come across women who are interested in me or anyone based on whether or not they have money.

Second, to the extent that anyone DOES like money, I think they like people who SPEND a lot of money, not SAVE a lot of money. I imagine if I rolled up to a club with a fancy car and fancy clothes and buy fancy drinks, maybe I would attract a different kind of person? Or if I’m being honest, I still wouldn’t, and would go home lonely having wasted a lot of money. But to the extent that there are any women interested in money, they generally have never been interested in me based on the way I spend it.

Third, I think liking “money” is often conflated with other things. Like being responsible and ambitious. I’ve generally been pretty responsible and ambitious throughout my adult life in a way that doesn’t correlate to what’s in my bank account. So the same kind of woman who likes me now for those reasons may have liked me in my twenties or the same reasons, keeping that romantic interest line flat.

I’d like to add this isn’t a thirst trap or dating profile. I’m actually happily dating someone! But she isn’t a social media person, so out of respect to her I’ll use some DISCRETION and not blast her name and face all over my instagram. But if I ever get married I’ll let you know.

p.s. My “fat fire” number has always been $5M. Growth towards that goal has felt really slow, but looking at this chart in a snapshot certainly seems encouraging! I’m at about $4.75M after a great June for the market!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy