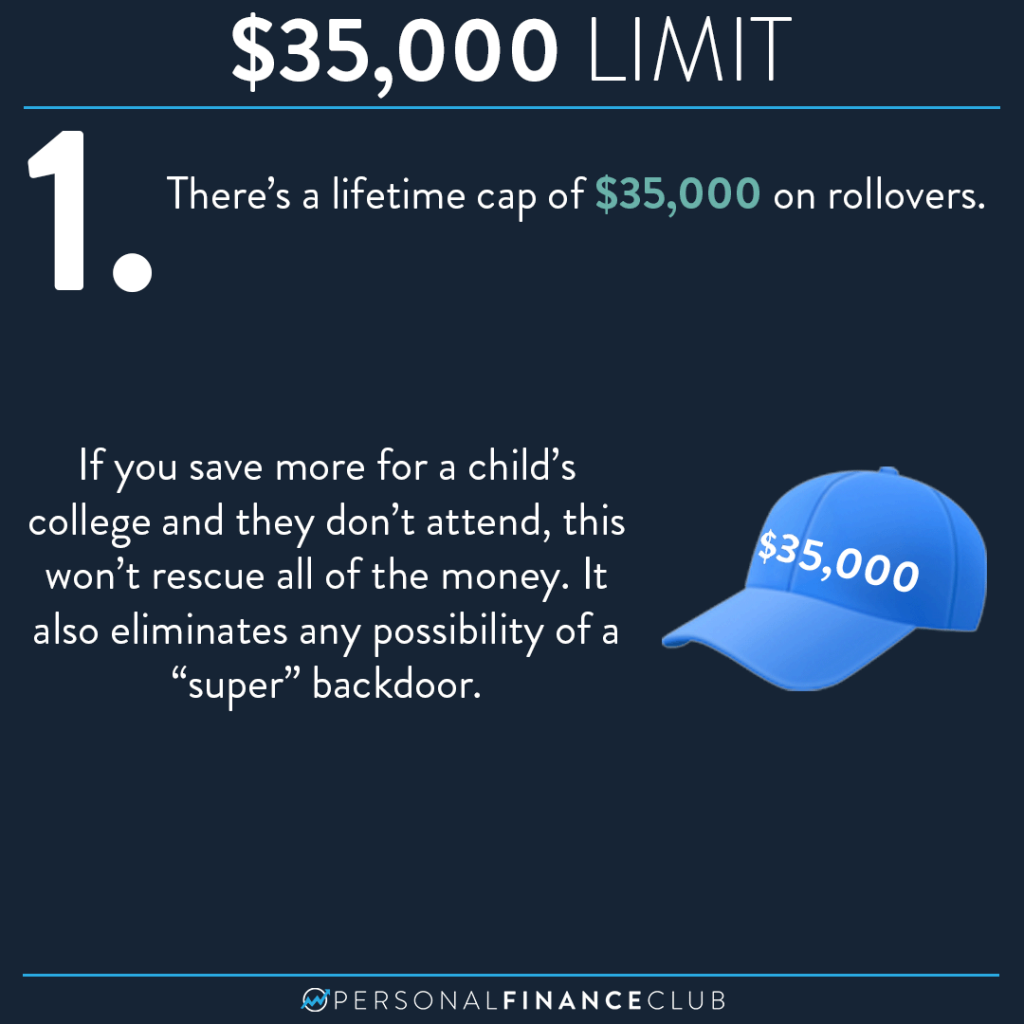

When I first heard that rollovers from a 529 to Roth IRA were going to be allowed, my eyes got wide and images of funneling untold mountains of cash into my Roth IRA started dancing in my head. But I gotta hand it to congress, I think they did a solid job of closing the loopholes so millionaire douchebags like me can’t use a 529 to avoid taxes.

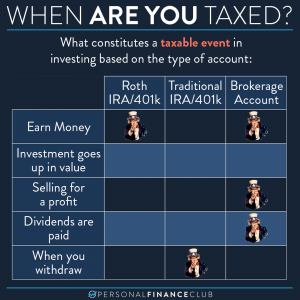

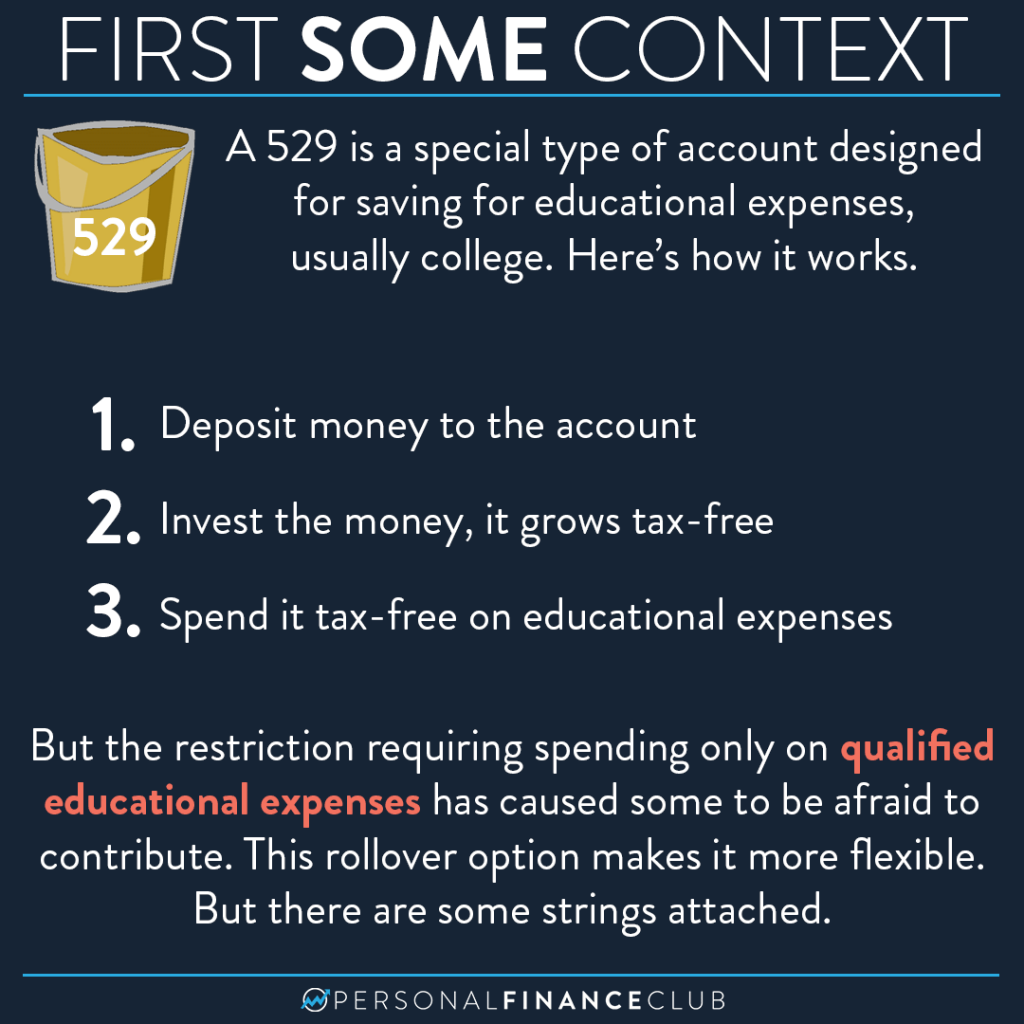

529s are nice investment accounts because they have no income limit and high contribution limits ($235K-$550K depending on the state). Any money contributed to a 529 is invested and grows tax free. You can then spend that money tax free on any qualified educational expense. The typical use case is a parent saving money for a child’s college tuition. It works great for that.

But what if they don’t go to college!? Before this law, there were a couple options. First, you can change the beneficiary on a 529 account any time. So if you have another family member who needs the money, they could use it. The last resort is to pay taxes and 10% penalty on the growth. Not great, and makes the whole 529 kind of pointless, but at least you get most of the money back.

This new law (which takes effect in 2024) gives 529 account holders some more flexibility. Let’s say you save $100K for a kid’s college and they only need $80K because they get a scholarship. That last $20K can basically fund their Roth IRA for four years or so! That’s a nice start to a child’s investment journey!

So my momentary dream of max funding a 529 with myself as the beneficiary, then immediately rolling it over to my Roth IRA and enjoying a lifetime of tax-free growth has died. BUT this is still great news for those saving for educational expenses!

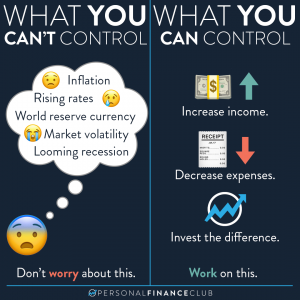

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram

September Sale!

September Sale!