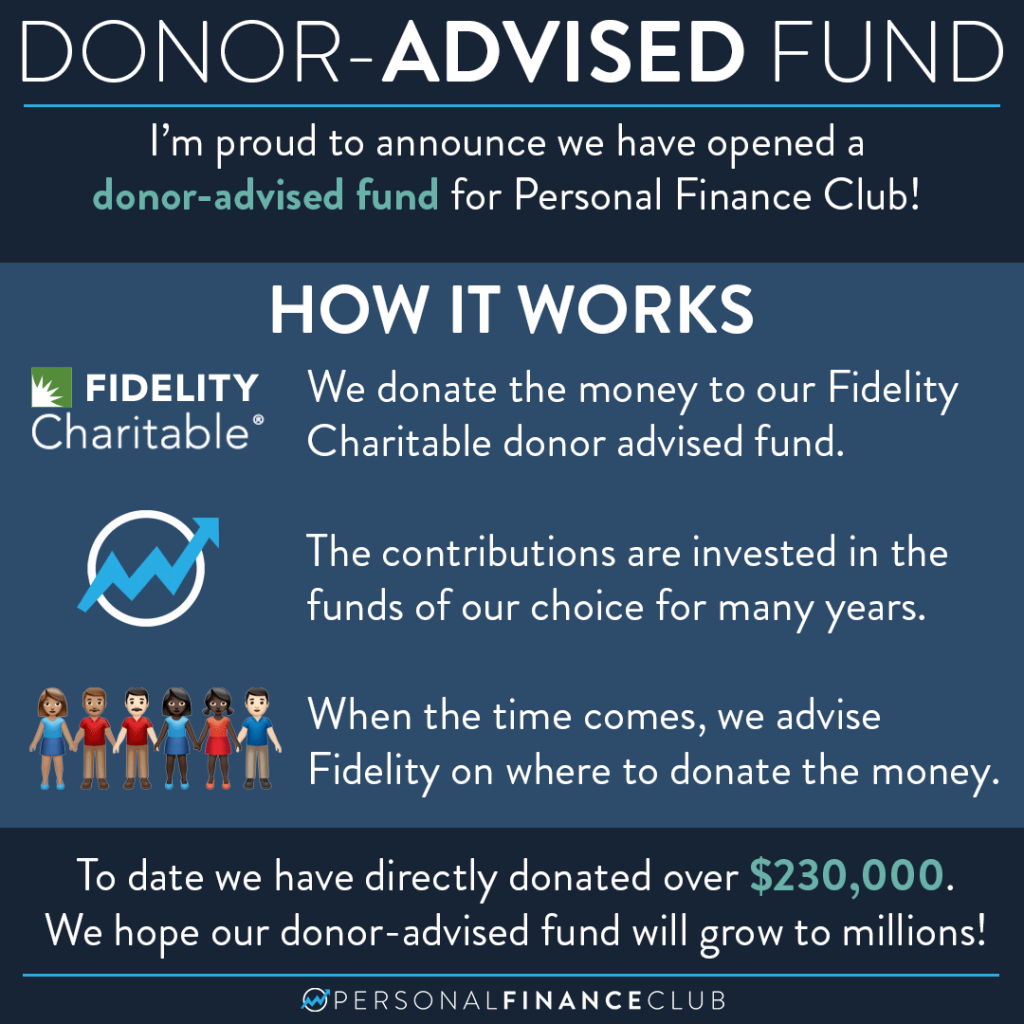

Loyal PFC fans may be familiar with fact that we have been donating 20% of our sales to charity since we started selling the first course! That means over the last couple of years we have donated over $230,000! How cool! We have been donating to mostly different charities each month with the lion’s share going to charities that make the biggest impact per dollar, like GiveWell.

Going forward, we STILL plan to donate 20% of sales to charity but now we’re going to make use of a “Donor-Advised Fund”. It’s a non-profit itself, whose job is to hold, invest, and eventually grant the money at our direction. This seems like a great fit for us because it marries our charitable giving with our penchant for investing. The goal would be to let that money grow and compound and do even MORE good down the road.

Our idea for now is to directly donate 25% of our allotted giving each month to charities for use now, and donate the other 75% to the donor-advised fund. We’ll keep you updated on the running balance of the donor-advised fund! Note that the donor-advised fund IS ITSELF a non-profit, so the donation counts the month we do it. There’s also no take-backsies. We can’t withdraw the money or use it for any other purpose. It’s got to go to other charities.

In addition to the benefit of investing, it also can simplify the decision making around charitable giving if you want to make the donation now (and get the tax break for the current year) but aren’t sure who should be the eventual recipient.

If you want one for yourself, there’s a bunch of options online that make it easy. We used fidelitycharitable.org which generally seems pretty good for now. (As always, they’re not a sponsor or even aware of my existence as far as I know, it’s just what I happen to use!)

We’re hoping to grow our fund to millions and maybe let just the GROWTH of the money fund charitable initiatives! 🙂

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy

via Instagram