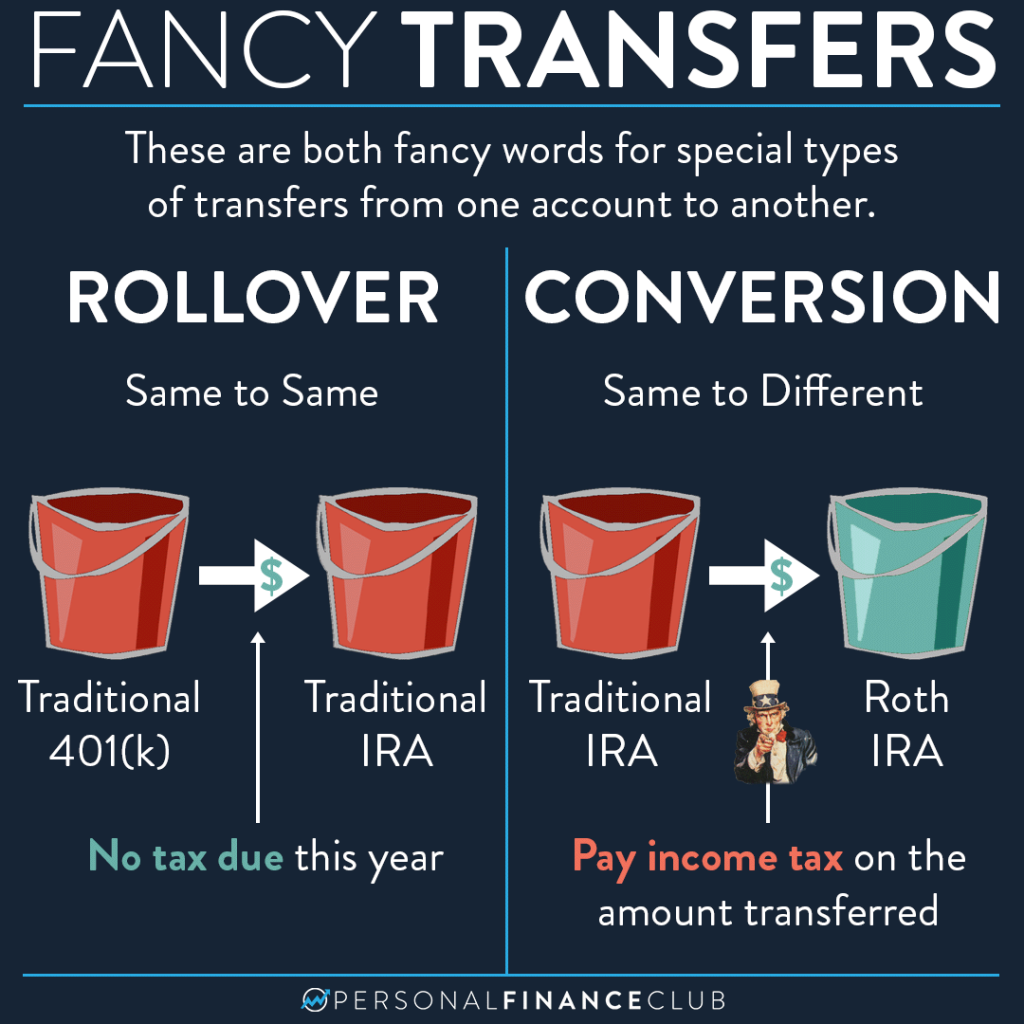

These two words confuse people a lot, so I’ll try to break them down simply!

First of all, both of these things are transferring money (or investments) from one account to another. Often you initiate this by simply clicking the “transfer” button on your brokerage website. If you’re transferring between brokerages, it is a little more involved, but the idea is the same. So what are they:

Rollover: A rollover is a transfer from one account to another when they both have the same tax status. Tax status is generally either “traditional” (pre-tax) or “Roth” (post-tax). The most common rollover is from an old company’s Traditional 401(k) to your personal Traditional IRA. The money in that 401(k) has never been taxed, and rolling it over to your Traditional IRA simply moves the money and/or investments into your IRA and keeps the money in “never been taxed” status.

Conversion: A conversion is a transfer from a Traditional account to a Roth account. The most common conversion is from a Traditional IRA to a Roth IRA. For example, if you have $10,000 in a Traditional IRA, you have never paid income tax on that money (unless you made non-deductible contributions, like for a backdoor Roth IRA, but that’s another story). Let’s say you want to transfer that $10,000 to a Roth IRA. You’re welcome to do so by clicking the “transfer” button. But at tax time, you’ll get a form that says you converted $10,000 and you have to add that amount to your income tax for this year.

Most generally, you probably don’t want to do “conversions” unless you have a good reason to. A good reason might be “I’m in a low tax bracket this year, so might as well take advantage of that and get this income tax out of the way forever”.

As with everything in this world, there are more complexities when you dig a little deeper, but that’s rollovers and conversions 101 at least.

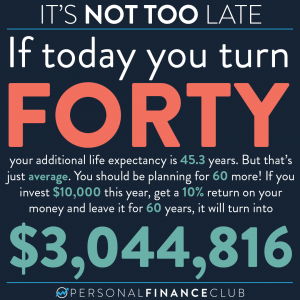

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy